yowordpress.ru Categories

Categories

What Is The Cost Of Granite

/cost-of-granite-countertops-1822205_hero_10733-1b3c02a587b74886a31a2ef2f17270eb.jpg)

The price of prefabricated granite starts at approximately $25 per square foot. Limitation of the pre-fabricated granite is that you cannot have custom fit. Granite is the most popular natural stone countertop material used in kitchens and bathrooms and comes in dozens of colors. Typical costs. A slab of granite can cost anywhere from $35 to $60 per square foot, depending on the type of granite selected. Get Granite Countertop price options and installation cost ranges. Free, online Granite Countertop cost guide breaks down fair prices in your area. Easy Financing Available. best offer price. We stock the best. Prices for tiles typically range from $25 to $50 per square foot, which includes labor costs for installation. On the other hand, the average cost of a granite. How Much Do Granite Countertops Cost? The average cost to install granite countertops in a bathroom typically ranges between $1, to $4, for a standard. Meanwhile, the average cost of marble countertops starts at $ / square foot and can actually be as much as $ / square foot! In general, it's more. On average, you can expect the cost to be between $65 and $ per square foot installed for granite counters. different types of granite countertops installed. The price of prefabricated granite starts at approximately $25 per square foot. Limitation of the pre-fabricated granite is that you cannot have custom fit. Granite is the most popular natural stone countertop material used in kitchens and bathrooms and comes in dozens of colors. Typical costs. A slab of granite can cost anywhere from $35 to $60 per square foot, depending on the type of granite selected. Get Granite Countertop price options and installation cost ranges. Free, online Granite Countertop cost guide breaks down fair prices in your area. Easy Financing Available. best offer price. We stock the best. Prices for tiles typically range from $25 to $50 per square foot, which includes labor costs for installation. On the other hand, the average cost of a granite. How Much Do Granite Countertops Cost? The average cost to install granite countertops in a bathroom typically ranges between $1, to $4, for a standard. Meanwhile, the average cost of marble countertops starts at $ / square foot and can actually be as much as $ / square foot! In general, it's more. On average, you can expect the cost to be between $65 and $ per square foot installed for granite counters. different types of granite countertops installed.

We provide FREE ESTIMATES on custom granite counters. The pre-cut and polished slabs you will see in our showroom allow for much faster and less. Depending on the type of granite you select, including color, level, and thickness, you can expect to pay anywhere between $35 to $ per. Our “Builder Series” of granite countertops start at $42/square foot installed. Mid-Exotic and Exotic stones range anywhere from $45/square foot on up to $80/. Blue Dunes Leather " Prefabricated Granite Countertop. SKU#: $ ; Thunder White " Prefabricated Granite Countertop. SKU#: $ The price of the finished project can range from $39 – $ per square foot, installed. Most of the projects we complete for our customers fall into the range. prices may vary from those displayed. Products shown as available are normally stocked but inventory levels cannot be guaranteed. For. The typical cost of new granite countertops is around $2,, including materials and installation, for 30 square feet. The typical cost range of installing. Granite is one of the most expensive counter materials, but there are options for those who have a limited budget, thanks to tiles, overlays, and modular. We provide FREE ESTIMATES on custom granite counters. The pre-cut and polished slabs you will see in our showroom allow for much faster and less. Granite countertops cost between $85 to $ per square foot on average which includes materials, labor, and installation. On the low-end, you can expect to. To get a "feel" for pricing, the least expensive industry-standard 3-cm (~inch) thick black and white granite countertops range from $ to $/. We're gonna choose quartz instead of granite for the time being and then get granite decades down the road. Has anyone ever made the same decision recently? Because it must be fabricated and installed by professionals, the cost of installation is usually added to the cost of the stone. Granite can cost between. How Much Are Granite Countertops Slabs? Granite slab countertops are relatively popular but are often the most expensive option. They can cost you anywhere. Prices for tiles typically range from $25 to $50 per square foot, which includes labor costs for installation. On the other hand, the average cost of a granite. Granite Transformations charges about $40 to $80 per square foot plus labor, with their countertops coming with a lifetime limited warranty.. Their labor rate. Every market is slightly different but for the most part you can have granite countertops in your home for around $/square foot. The Cost of Granite: Granite presents a wealth of options that cover a large range of prices. The cost of a granite slab is anywhere from $17 to $60 per square. Expect to pay between $50 and $ per sq. ft. to get a slab of granite countertop installed. Most homeowners pay $$ per sq. ft. That'd be around $2,$.

How To Add Admin Access To Linkedin Company Page

Sign in to Business Manager. · Click Pages in the menu on the left side of the page. · Click the name of the Page. · Click Add people in the upper-right corner of. Being the admin of the company page, how can I access the posts from that company via LinkedIn api. I was made to be an admin to my company. Click Settings in the left menu, then select Manage admins. Click the Page admins or Paid media admins tab. Click the Add admin button. Tap your profile picture, then tap your Page name below Pages you manage. Tap Show more to see more Page names. · You'll be routed to your super admin view. Sign in to your LinkedIn profile that has admin access to the LinkedIn Page. · Tap your profile picture in the upper-left corner. · From the Manage pages section. Click “Edit” on the top right, and then click “Add User” to your account. Add the new user email address. Note: You can paste in the member's LinkedIn public. Page admins. Super admin - Gives access to every Page admin permission available, including adding and removing any type of admin, editing Page information. Click the 'Admin tools' at the top right of the page and choose page admin. 8. Select the type of admin you want to add from the options on the left side of the. Finding LinkedIn company page administrators is not difficult. Look for the “People” section of your target company's webpage. Sign in to Business Manager. · Click Pages in the menu on the left side of the page. · Click the name of the Page. · Click Add people in the upper-right corner of. Being the admin of the company page, how can I access the posts from that company via LinkedIn api. I was made to be an admin to my company. Click Settings in the left menu, then select Manage admins. Click the Page admins or Paid media admins tab. Click the Add admin button. Tap your profile picture, then tap your Page name below Pages you manage. Tap Show more to see more Page names. · You'll be routed to your super admin view. Sign in to your LinkedIn profile that has admin access to the LinkedIn Page. · Tap your profile picture in the upper-left corner. · From the Manage pages section. Click “Edit” on the top right, and then click “Add User” to your account. Add the new user email address. Note: You can paste in the member's LinkedIn public. Page admins. Super admin - Gives access to every Page admin permission available, including adding and removing any type of admin, editing Page information. Click the 'Admin tools' at the top right of the page and choose page admin. 8. Select the type of admin you want to add from the options on the left side of the. Finding LinkedIn company page administrators is not difficult. Look for the “People” section of your target company's webpage.

Add New Admin: Click on 'Add Admin' and start typing the name of the person you wish to add as an administrator. Assign Roles: Choose the appropriate role for. No, LinkedIn doesn't send a notification when you remove an admin from a company page. However, the person might notice if they try to access admin features. Click “See admins” to see the list of current admins for your LinkedIn company page. 5. If you're a 1st-degree connection of any administrator you can request. How to Add a LinkedIn Admin · Go to your company page and click on the Admin tools button. · Click on the Page settings tab. · Under the Page roles section, enter. Here is the step-by-step process to give someone access to your LinkedIn Page. There are four admin roles that you can assign. You'll find the “For Business” button on the right-hand side of your LinkedIn profile. Once you click on it, you'll find the “Create a Company Page” option. Access your Page Super admin view. Click the Admin tools dropdown at the top of the page and select Manage admins. Click the Page admins or WebOct 6, ·. How to make someone super admin on Linkedin company page ; 2. Click here. ; 3. Click "Company: Scribe" ; 4. Click this icon. ; 5. Click "Manage admins" ; 6. Click. Each role gives you permission to perform a set of tasks on behalf of your Page. Related tasks Learn more Add admins on your LinkedIn Page Edit your Request. If you're a Content Admin, you can only create new posts and post as the page elsewhere on LinkedIn. If you don't have a page yet, you can claim an existing. Edit your Page admin's role · Add admins on your LinkedIn Page · Add Page admin access for a requesting member · Add paid media admin roles to an existing LinkedIn. I can post, react and all but I can't edit company logo, edit the settings or even view admin access for it. And on my PC when I click on the. Select “Manage Admins” under the settings tab. 5. Search for the person you want to add as a user. They need to have a LinkedIn account to access this page. 6. LinkedIn Page super admins can add, edit, or remove the page and paid media admins through the Super admin view or an email notification process. Important to know ; Create Product Pages · Edit Product Pages · Analytics ; ✓ · ✓ · Analytics ; ✓ · ✓. Analytics. Go to your Page super admin view. · Click Settings in the left menu. · Click Manage admins. · Click the Paid media admins tab. · Click the Add paid media admin. 1) Log-in to the LinkedIn Account that has current Admin access to your LinkedIn business page. In this account, you will have a request to connect from. In order to link your LinkedIn Business Page to Cloud Campaign you must use a login with Super Admin access. To verify your login access status, log in to the. All Pages must have at least one super admin. To remove your Page admin's role: Related tasks Add admins on your LinkedIn Page Add Page admin access for a. Who can use this feature? · Sign in to Business Manager. · Click Pages in the menu on the left side of the page. · Click the name of the Page. · Search for the.

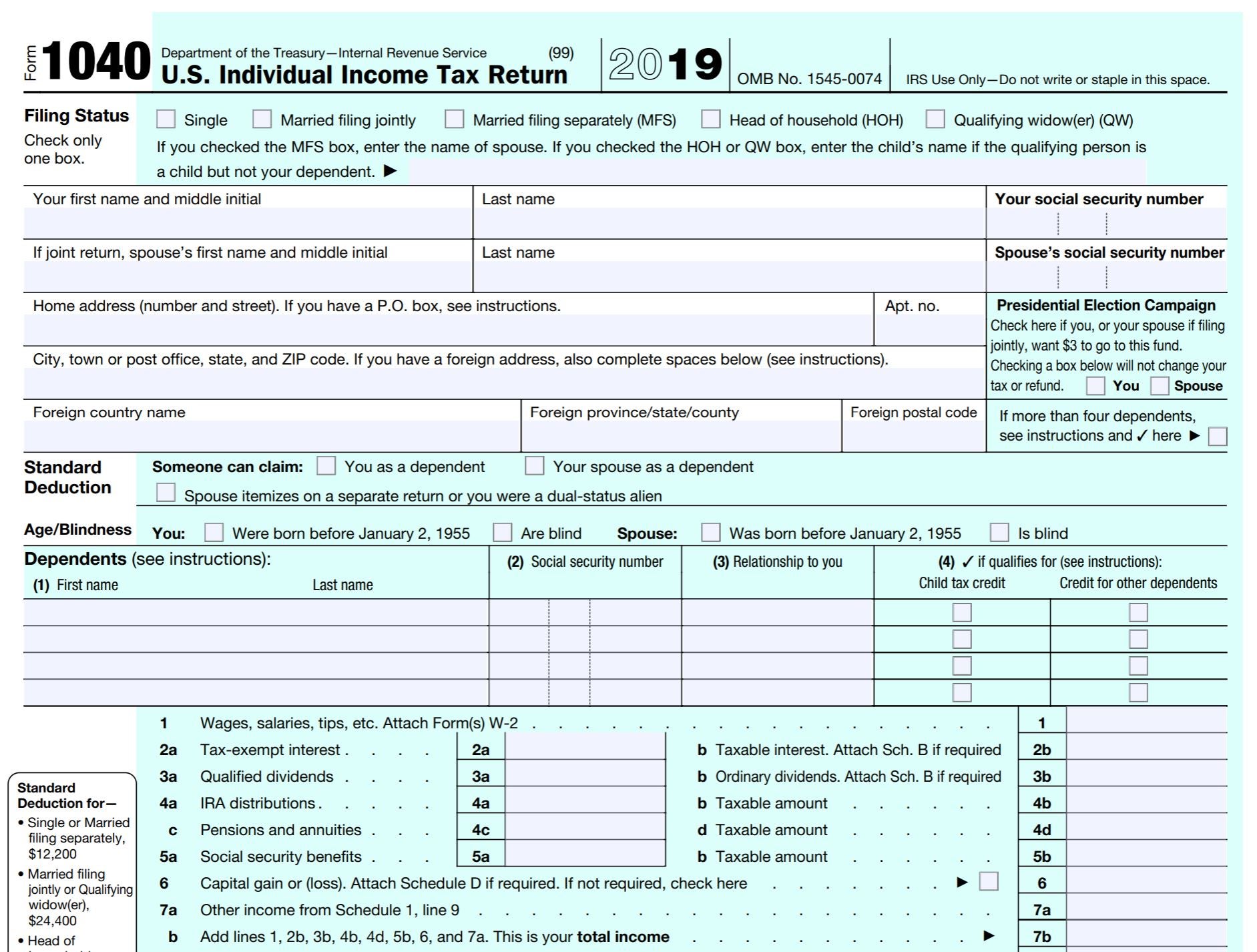

What To Do To File Back Taxes

You can file a late return without an extension. If you do not owe taxes or you expect a refund, you may not owe a penalty. If you owe taxes, you may be charged. file your tax return, the IRS may file a substitute return for you. But What should you do if you didn't file taxes last year? It's not too late to. There's no penalty for failure to file if you're due a refund. However, you risk losing a refund altogether if you file a return or otherwise claim a refund. If you do not have business activities during your filing period, you must still file your return by the due date using one of the following options. How to file back taxes in 5 steps · Gather necessary documents. Foremost, collect all relevant documentation for each tax year. · File your tax returns. Then file. Select Direct Deposit (at no extra fee) to receive your refund faster. State Tax Forms and e-file are available for ALL STATES with individual income tax. Learn. Filing an extension request form for · Then start filing your back tax returns starting with ,and then proceeding with , , and. Filing electronically, and requesting direct deposit if you're expecting a refund, is the fastest, safest, and easiest way to file your return. What to do if you owe the IRS · 1. Set up an installment agreement with the IRS. · 2. Request a short-term extension to pay the full balance. · 3. Apply for a. You can file a late return without an extension. If you do not owe taxes or you expect a refund, you may not owe a penalty. If you owe taxes, you may be charged. file your tax return, the IRS may file a substitute return for you. But What should you do if you didn't file taxes last year? It's not too late to. There's no penalty for failure to file if you're due a refund. However, you risk losing a refund altogether if you file a return or otherwise claim a refund. If you do not have business activities during your filing period, you must still file your return by the due date using one of the following options. How to file back taxes in 5 steps · Gather necessary documents. Foremost, collect all relevant documentation for each tax year. · File your tax returns. Then file. Select Direct Deposit (at no extra fee) to receive your refund faster. State Tax Forms and e-file are available for ALL STATES with individual income tax. Learn. Filing an extension request form for · Then start filing your back tax returns starting with ,and then proceeding with , , and. Filing electronically, and requesting direct deposit if you're expecting a refund, is the fastest, safest, and easiest way to file your return. What to do if you owe the IRS · 1. Set up an installment agreement with the IRS. · 2. Request a short-term extension to pay the full balance. · 3. Apply for a.

DOR urges everyone to wait to file their tax returns until they receive all their official tax documents and statements. file an Ohio individual and/or school district income tax return reporting tax due, but do not pay their balance in full. OHID for Ohio's Taxpayers. March You can file up to 3 years from the original deadline date. You can e-file up years late. After that, you must mail in paper returns. You may be able to. Filing online is the fastest and easiest way to complete your return, which means we can start processing it faster. , If you're expecting a refund. Prepare old tax returns online. Federal filing is always free. State filing is $ File back taxes for , , , and other years. You can take advantage of e-file in one of two ways: 1. Ask your tax preparer. If your tax preparer is an authorized IRS e-file provider, your preparer can. When it comes time to file, you will use those documents to fill out a Form —the IRS form for individual income taxes. 4. Learn which credits and deductions. DO NOT mail a copy of your return. Submitting multiple original returns will cause processing delays. What about my refund? You can check the status of your. Complete your tax return with specialized software that accounts for the complexities of military life; Connect with a tax pro; File federal and up to three. Jackson Hewitt is open and ready to help you file or assist with your late tax needs. Find expert Tax Pros in your neighborhood today. No further delay! Learn more about filing a tax extension, late payment and late filing penalties, and what to do if you can't pay your taxes. For taxpayers filing using paper forms, you should send us Your North Carolina income tax return (Form D). Federal forms W-2 and showing the amount. Correcting Maryland taxes withheld in error. If Maryland tax was withheld from your income in error you must file to obtain a refund. Complete all of the. You can check your refund status starting from Where's My Refund. Electronic Filing Options. Get A Jump On Your Taxes With FreeFile! Iowa tax season officially. File Individual State Income Taxes · Get Prepared. Complete your federal tax return before beginning your state tax return. · Gather What You'll Need. Federal tax. When your return is complete, you will see the date your refund was issued. Secondary Navigation Menu. Taxes · File My Taxes · Where's My Refund · Make a. Yes. You were sent a notice when your case was initially submitted for federal tax refund offset. The federal government should send an offset notice to you. How to File Back Taxes for Your Tax Return · Gather your tax documents for the missing year(s). · Request missing documentation from the IRS. · Download prior year. No income limitations or other qualifications must be met to take advantage of ALDOR's free online filing system. Please visit My Alabama Taxes to sign up and. Where's My Refund? File an Extension · Where's My G? Earned Income Tax Credit (EITC) · MVA Tax Certification · CASH Campaign of Maryland · Maryland.

Are Banks Closed Today

**For holidays falling on Sunday, all Federal Reserve Banks and Branches will be closed the following Monday. Expanded schedule can be found at: Federal. Access a list of national and provincial holidays for the Bank of Canada. September 30, National Day for Truth and Reconciliation. National holiday. Banks and Branches will be open the preceding Friday. **For holidays falling on Sunday, Federal Reserve Banks and Branches will be closed the following Monday. Texas National Bank locations will be closed in observance of the following holidays Apply Online Today. Apply Now. Personal Loans Apply | Learn More. Canada (Ontario): complete schedule of public and bank holidays, closure of banks and stock exchanges, school vacations, trade fairs, cultural and sporting. For holidays falling on Saturday, Federal Reserve Banks and Branches will be open the preceding Friday; however, the Board of Governors will be closed. Federal Reserve Bank of New York offices are closed on Saturdays and Sundays and the following holiday observances. Bank Holiday Schedule ; Federal Holiday. Date Observed. Hours ; New Year's Day, Mon. January 1st, , All Bank Locations Closed ; Birthday of Martin Luther King. Bank Holidays: · Labor Day: Monday, September 2 · Columbus Day: Monday, October 14 · Veterans Day: Monday, November 11 · Thanksgiving Day: Thursday, November. **For holidays falling on Sunday, all Federal Reserve Banks and Branches will be closed the following Monday. Expanded schedule can be found at: Federal. Access a list of national and provincial holidays for the Bank of Canada. September 30, National Day for Truth and Reconciliation. National holiday. Banks and Branches will be open the preceding Friday. **For holidays falling on Sunday, Federal Reserve Banks and Branches will be closed the following Monday. Texas National Bank locations will be closed in observance of the following holidays Apply Online Today. Apply Now. Personal Loans Apply | Learn More. Canada (Ontario): complete schedule of public and bank holidays, closure of banks and stock exchanges, school vacations, trade fairs, cultural and sporting. For holidays falling on Saturday, Federal Reserve Banks and Branches will be open the preceding Friday; however, the Board of Governors will be closed. Federal Reserve Bank of New York offices are closed on Saturdays and Sundays and the following holiday observances. Bank Holiday Schedule ; Federal Holiday. Date Observed. Hours ; New Year's Day, Mon. January 1st, , All Bank Locations Closed ; Birthday of Martin Luther King. Bank Holidays: · Labor Day: Monday, September 2 · Columbus Day: Monday, October 14 · Veterans Day: Monday, November 11 · Thanksgiving Day: Thursday, November.

Create an account today! Personal · Business. Menu. Tools & Resources · Customer Solutions Center. Bank Holidays. Bank Holidays. The following is a list of. In addition to the holidays cited above, banks are authorized to close at A bank may also select one additional day of the week to remain closed by. Most bank branches in Canada operate on a six-day working week– opening Monday to Saturday and usually closed on Sundays. TD Bank stores are closed on the following federal holidays in Our supermarket stores follow the same holiday schedule as traditional TD stores. City National Bank of Florida Will Be Closed On The Holidays Listed Below ; ; New Year's Day: January 1 ; Martin Luther King Jr. Day: January Canadian banks are open all throughout the week, that is, all 6 days from Monday to Saturday. But there are also certain exceptions, like CIBC and TD Bank. Nevada Bank & Trust locations will be closed on the following Federal and State holidays Apply For A Mortgage Today! Resources. Back. Resources. Bank Holidays. Texas Capital Bank will be closed in observance of the following holidays: Current Rates · Wire & ACH Instructions · Disclosures · Standard. Bank Holiday Closing Schedule ; Independence Day. Thursday, July 4 ; Labor Day, Monday, September 2 ; Indigenous Peoples' Day/Columbus Day, Monday, October In observance of the Federal holidays listed below, all branches of First Oklahoma Bank will be closed: Are you a current First Oklahoma Bank Customer? Below is the holiday schedule observed by the Federal Reserve System. Saturday - the Federal Reserve Banks are open but the Board of Governors is closed. Open An Account · Log In Open An Account · Home Go to the yowordpress.ru Home page. Log ' Apply Today · Wealth Wealth Dropdown. Wealth Management · Planning and. Holiday policy: When holidays fall on Saturday, Federal Reserve Banks and branches will be open the preceding Friday. For holidays falling on Sunday, all. Indiana University, Federal Reserve, Fifth Third, JPMorgan Chase ; New Year's Day Monday January 1, , Closed, Closed, Closed, Closed ; Martin Luther King Jr. The Federal Reserve Banks close in observation of several public holidays. If any of the following holidays falls on a Saturday, Federal Reserve Banks will be. **For holidays falling on Sunday, all Federal Reserve Banks and Branches will be closed the following Monday. Expanded schedule can be found at: Federal. The Federal Reserve Bank of Dallas and its branches at El Paso, Houston, and San Antonio, Texas will be closed on the following holidays in View the holidays observed by Mid America Bank. The bank will be closed during these holidays. For holidays falling on Saturday, the Bank and Branch offices will be open the preceding Friday; however, the Board of Governors will be closed. For. Public Holidays on Which Banks May Be Closed ; INDEPENDENCE DAY. July 4. Thursday ; LABOR DAY. September 2. Monday ; COLUMBUS DAY/INDIGENOUS PEOPLE'S DAY.

Best Open Account Offers

Your account must be open, in good standing and must have a balance greater Get a $ cash bonus when you open a new Relationship Checking account. Savings account bonus. Regions LifeGreen® Savings If you have a Regions checking account, you can save money and earn interest with no monthly fee, no minimum. SoFi offers up to a $ bonus for any new customer opening a Better Online Bank Account who can put at least $5, of direct deposits into the account within. Cash back deals. Want to put more in savings? Search participating merchants and earn up to 10% cash back on everyday purchases. Find the best fit for your business banking accounts with Navy Federal Credit Union Rates on variable rate accounts could change after account opening. Fees. Compare our savings account rates to find the best savings account or CD account to reach your future savings goals offers interest-bearing savings accounts. Take advantage of the best checking account bonuses to earn hundreds of dollars by opening a new account. See bonuses from Huntington Bank, Truist, and more. Open a new account and enjoy a new account bonus offer | Earn up to $ Account must be in an open status and in good standing at the time of payout. Get $ with our checking account bonus offer. Earn $ when opening an eligible Fifth Third checking account with qualifying activities. Offer expires. Your account must be open, in good standing and must have a balance greater Get a $ cash bonus when you open a new Relationship Checking account. Savings account bonus. Regions LifeGreen® Savings If you have a Regions checking account, you can save money and earn interest with no monthly fee, no minimum. SoFi offers up to a $ bonus for any new customer opening a Better Online Bank Account who can put at least $5, of direct deposits into the account within. Cash back deals. Want to put more in savings? Search participating merchants and earn up to 10% cash back on everyday purchases. Find the best fit for your business banking accounts with Navy Federal Credit Union Rates on variable rate accounts could change after account opening. Fees. Compare our savings account rates to find the best savings account or CD account to reach your future savings goals offers interest-bearing savings accounts. Take advantage of the best checking account bonuses to earn hundreds of dollars by opening a new account. See bonuses from Huntington Bank, Truist, and more. Open a new account and enjoy a new account bonus offer | Earn up to $ Account must be in an open status and in good standing at the time of payout. Get $ with our checking account bonus offer. Earn $ when opening an eligible Fifth Third checking account with qualifying activities. Offer expires.

Earn your checking bonus in 3 easy steps1 Earn your savings bonus in 3 easy steps · Earn $ with a new TD savings account. · Earn up to $ with a new TD. yowordpress.ru This page is constantly updated. If you just go to the homepage there are multiple. Marcus by Goldman Sachs® offers an online savings account with a rate that beats the National Savings Average. Learn more and open an online savings account. We offer a basic personal checking account that is free of charge, which includes unlimited check writing and no minimum balance required. Earn a $ cash bonus when you open a Fifth Third Momentum checking account and make $2, in direct deposits within the first 90 days. It's really that. best bank account options and strategies for your situation. Education & Discussion. banking basics. What Do You Need to Open a Bank Account Difference. M&T Bank offers several checking account options from interest bearing accounts and accounts with overdraft protection to checkless accounts. offers one of the highest savings rates we found and has just a $1 minimum deposit to open an account. Standout benefits: There's no cap to earning Western. For example, Bank of America, Chase Bank, and Wells Fargo offer a measly APY of % on their savings accounts, whereas most of the options listed above are. When you open a bank account with Capital One it means no waiting in line for account access, plus great rates and zero fees - all in one place. The SoFi bank account currently has the highest APY of any account on our list. Plus, it has one of the highest new customer bank bonus offers: up to $ NEW CUSTOMERS ONLY. MIN/MAX STAKE £1. FREE BETS CREDITED ON TOP OF WINNINGS WITHIN 72 HOURS. FIRST SINGLE & E/W BET ONLY. 5 X £10 BET TOKENS. A bonus to the tune of $ Yours to earn with a new TD savings account and qualifying activities. Open in minutes. Check your local rates before opening an account. Open an Elite Money Market Account. Traditional savings accounts. Standard Savings Account. Best for. First. Top current accounts that give bonuses for switching Banks sometimes offer bonuses to new customers who switch in an existing current account to a new current. As a new Chase checking customer, enjoy a $ checking account promotion when you open a Chase Total Checking® account with qualifying activities. For example, we typically do not pay overdrafts if your account is not in good standing or if the overdraft amount is excessive. 3 Citizens offers two overdraft. Access to new features. We're dedicated to giving you the best experience so you can enjoy even more benefits as we continue to enhance the account. SPECIAL OFFER · 1. Open a Free Checking account with direct deposit · 2. Set up Online Banking and eStatement · 3. Make 5 debit card purchases. Earn up to a $ cash bonus when you open a new SoFi Checking and Savings account online with direct deposit. Take advantage of this promotion today!

What Is A Tax File

1. Keep an eye on your income. You need to file a tax return if you meet or surpass certain levels of income during the year. Personal tax filing assistance is available for individuals and families with disabilities, or households that meet certain income requirements. A federal tax return is a tax return you send to the IRS each year through Form , U.S. Individual Income Tax Return. It shows how much money you earned in a. Three ways to securely file your taxes this year. Before you start filing, collect your tax forms so you aren't scrambling once you start the process. DOR urges everyone to wait to file their tax returns until they receive all their official tax documents and statements. Make sure you get every tax credit and deduction you're entitled to. Before you get started on your taxes, make sure you have all the receipts and income. Direct File enables eligible taxpayers to file their taxes electronically, directly, and for free with the Internal Revenue Service (IRS). File your taxes for free with H&R Block Free Online. eFile taxes with our DIY free online tax filing service and receive the guaranteed max refund you. 1. Keep an eye on your income. You need to file a tax return if you meet or surpass certain levels of income during the year. 1. Keep an eye on your income. You need to file a tax return if you meet or surpass certain levels of income during the year. Personal tax filing assistance is available for individuals and families with disabilities, or households that meet certain income requirements. A federal tax return is a tax return you send to the IRS each year through Form , U.S. Individual Income Tax Return. It shows how much money you earned in a. Three ways to securely file your taxes this year. Before you start filing, collect your tax forms so you aren't scrambling once you start the process. DOR urges everyone to wait to file their tax returns until they receive all their official tax documents and statements. Make sure you get every tax credit and deduction you're entitled to. Before you get started on your taxes, make sure you have all the receipts and income. Direct File enables eligible taxpayers to file their taxes electronically, directly, and for free with the Internal Revenue Service (IRS). File your taxes for free with H&R Block Free Online. eFile taxes with our DIY free online tax filing service and receive the guaranteed max refund you. 1. Keep an eye on your income. You need to file a tax return if you meet or surpass certain levels of income during the year.

File your taxes with TurboTax®, Canada's #1 best-selling tax software. No matter your tax situation, TurboTax® has you covered with % accuracy. A Student's Guide to Filing Taxes: What you need to know · Tuition tax credit (excluding textbooks) · Childcare costs · Interest paid on qualifying student. File your taxes for free. Choose the filing option that works best for you. · File My Own Taxes · Have My Taxes Prepared for Me · Required Information · Credits. It does not include items that are exempt from Wisconsin tax. For example, it does not include social security benefits or U.S. government interest. If your. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. NYC Free Tax Prep for Individuals and Families · Visit yowordpress.ru · Sign into your account. · Submit tax documents using your smartphone, tablet, or. TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. Your tax return is a form you can complete online or by paper, get help from a tax agent or our Tax Help program. You are required to file a tax return in order to pay tax or receive a refund if you have paid too much tax. This informational guide on how to do taxes can help take the guesswork out of filing annual tax returns, which are typically due April Direct File enables eligible taxpayers to file their taxes electronically, directly, and for free with the Internal Revenue Service (IRS). filing requirements for most taxpayers: Gross income of at least $13, (individuals) or $27, (married filing jointly). Different thresholds apply for. File online using a purchased software tax filing product. The computer program will ask you to input information and then calculate your taxes. These programs. Tax is usually deducted automatically from wages and pensions. People and businesses with other income must report it in a tax return. If you need to send a. Tax returns are usually processed by each country's tax authority, known as a revenue service, such as the Internal Revenue Service in the United States, the. Get answers to tax-filing questions and find out how year-round tax planning may help you save and build more wealth over time. You may submit all forms, schedules, and payments by personal check, cashier's check, or money order in person to: Vermont Department of Taxes. A simple tax return is the most basic type of tax return you can file. Each tax filing program defines simple tax returns differently. Learn more in this section about financial benefits and where you can go to get help with accessing those benefits and filing your taxes - at no cost.

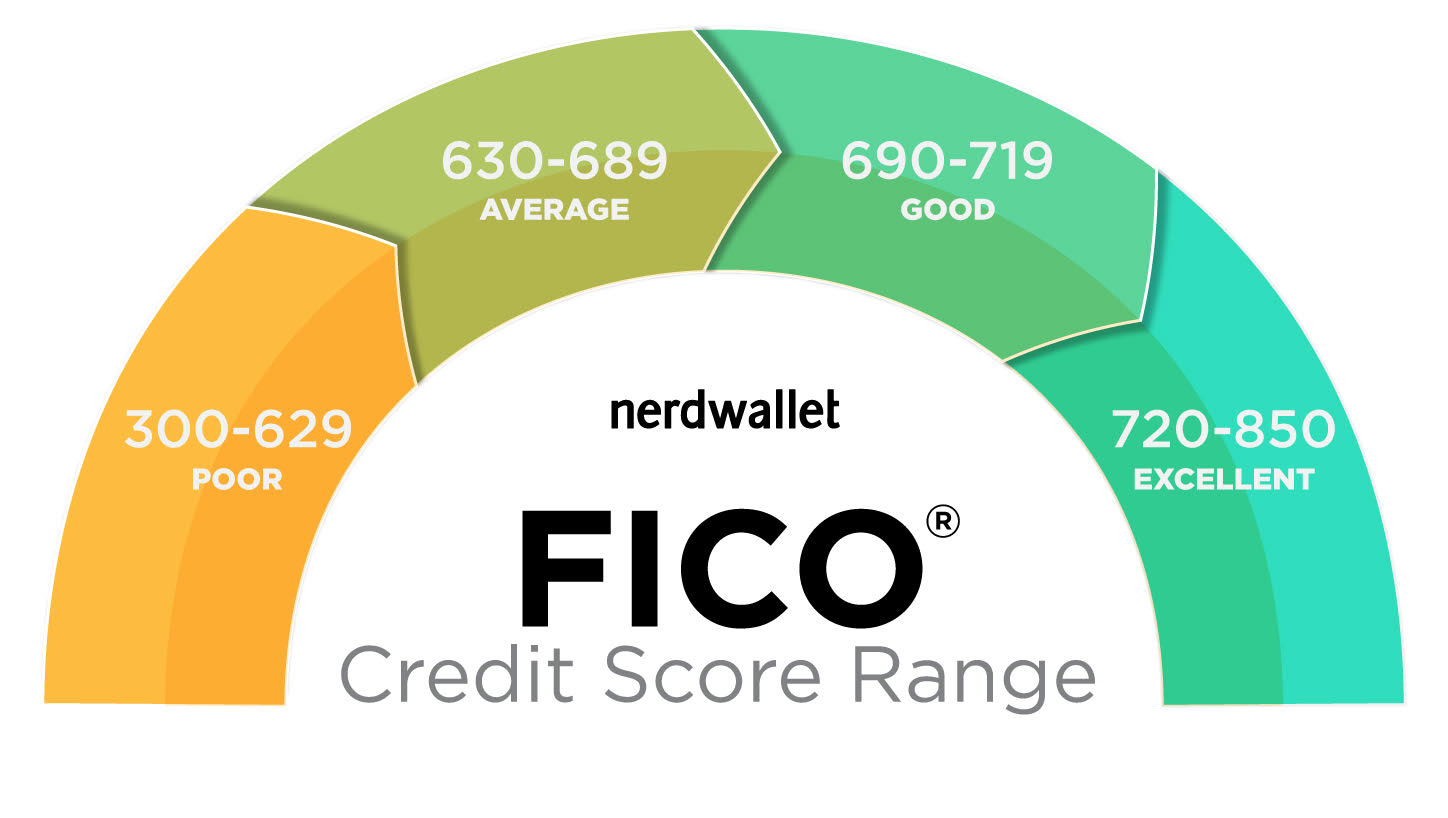

What Is The Credit Score Range To Buy A House

The minimum FICO score needed for a conventional loan is A borrower will get the best rate with a score of or higher. Someone with an. FICO ® Scores ; to Fair. Below the average of U.S. consumers. Some lenders will approve loans with this score ; Lower than Poor. Well below the. A FICO Score between and is generally considered to be in the very good to excellent credit score range to buy a home. If your score falls below this. All three bureaus grade your credit history on a range from , but your score will differ from bureau to bureau because not all creditors report to all. A FICO Score between and is generally considered to be in the very good to excellent credit score range to buy a home. With a credit score in this range, you'll only need a down payment of % to get an FHA loan. But all FHA borrowers must pay an up-front mortgage insurance. To increase your odds of approval and qualify for a lower-rate mortgage, you should aim to have a credit score in the good range. That's a FICO score of or. The exact range needed to buy a house can vary, but lenders generally prefer credit scores of or above and may reject anything below Your credit scores. Credit score requirements vary from lender to lender. However, for most conventional mortgages, homebuyers need a minimum credit score of for approval. The minimum FICO score needed for a conventional loan is A borrower will get the best rate with a score of or higher. Someone with an. FICO ® Scores ; to Fair. Below the average of U.S. consumers. Some lenders will approve loans with this score ; Lower than Poor. Well below the. A FICO Score between and is generally considered to be in the very good to excellent credit score range to buy a home. If your score falls below this. All three bureaus grade your credit history on a range from , but your score will differ from bureau to bureau because not all creditors report to all. A FICO Score between and is generally considered to be in the very good to excellent credit score range to buy a home. With a credit score in this range, you'll only need a down payment of % to get an FHA loan. But all FHA borrowers must pay an up-front mortgage insurance. To increase your odds of approval and qualify for a lower-rate mortgage, you should aim to have a credit score in the good range. That's a FICO score of or. The exact range needed to buy a house can vary, but lenders generally prefer credit scores of or above and may reject anything below Your credit scores. Credit score requirements vary from lender to lender. However, for most conventional mortgages, homebuyers need a minimum credit score of for approval.

The credit score necessary to buy a house varies depending on the lender and type of mortgage. For example, most conventional loans require a credit score. Many lenders use the FICO score, which grades a consumer's credit-worthiness on a - range. Poor = or lower; Fair = ; Good = A conventional mortgage will require a minimum FICO credit score of , while FHA loans require a score of over to qualify for a loan with a % down. Most standard home loan programs require you to meet minimum credit score requirements, which range from to Don't know your credit score? Get your. If you are opting for FHA/VA, the minimum is or above. If you want conventional, the minimum is or above. The minimum credit score needed for most mortgages is typically around However, government-backed mortgages like Federal Housing Administration (FHA). Home buyers with credit scores of or greater qualify for better mortgage interest rates, as well as for higher value homes that require “jumbo” mortgages. If we had to name the absolute lowest credit score to buy a house, it would likely be somewhere around a FICO score. It is very rare for borrowers with that. Credit scores range from to The Fair Isaac Corporation, also known as FICO, originally created this scale to help lenders and investors determine the. A good score is usually in the range of or higher: Exceptional What credit score is needed to buy a house with no money down? VA and. “FHA loans allow you to have a credit score of or higher and still be able to put only % down,” says Garett Seney, a mortgage advisor with Fairway in. The minimum credit score needed to buy a house depends on the mortgage program and the lender. According to mortgage company Fannie Mae, a conventional loan. A credit score of and above is generally considered to be an excellent credit score.2 The credit score range is anywhere between to The higher. Borrowers with credit scores of and above, though, will get the best mortgage loan options. In addition, they might not have to worry about which mortgage. A FICO® Score or higher is a common requirement with jumbo loans. When you are ready to borrow money to purchase a home, a lender will examine your credit. In Canada, credit scores range from around (the lowest) to (the highest). Anything above is considered good ( is considered good, is. Credit scores range from to The Fair Isaac Corporation, also known as FICO, originally created this scale to help lenders and investors determine the. Typically, people with scores in the good or excellent range have more access to better financial products. The two most prominent credit scores are from FICO. The minimum credit score needed to purchase a home can be anywhere from to depending on the type of mortgage. The information provided on this. FICO scores range from to While credit score thresholds differ by loan type, FHA loans require applicants to have a minimum score of to qualify for.

How Much Is The Car Insurance For New Drivers

There are many factors that are included in the cost such as age, driver's record, model and year of a vehicle, status as a primary or secondary driver, where. Car insurance companies see young male drivers as statistically more likely to take risks while driving than young female drivers. As such, the average cost of. Find out how to get the best car insurance for new drivers, including recommended coverages and how to get cheap car insurance as a new adult driver. Simply put, if your teen shows good grades and responsibility in school, they get a break on the price of car insurance. Typically, a teen must have a "B. Key takeaways · The average cost of car insurance in New York per month is $ for minimum coverage, while full coverage costs an average of $ a month. How much is the average cost of car insurance in the U.S? The average cost for car insurance in the United States is $1, per year, or $ per month. Insurance companies consider a young driver to be anyone who is under 25 years old when rating for car insurance. So if you are between 16 and 24 and have a. The average annual cost of a minimum coverage car insurance policy for a brand new driver is approximately $1,, and roughly $2, annually for “full. In Calgary, the average cost of insurance for a new driver can range anywhere from $2, to $5, per year, depending on various factors such as age, driving. There are many factors that are included in the cost such as age, driver's record, model and year of a vehicle, status as a primary or secondary driver, where. Car insurance companies see young male drivers as statistically more likely to take risks while driving than young female drivers. As such, the average cost of. Find out how to get the best car insurance for new drivers, including recommended coverages and how to get cheap car insurance as a new adult driver. Simply put, if your teen shows good grades and responsibility in school, they get a break on the price of car insurance. Typically, a teen must have a "B. Key takeaways · The average cost of car insurance in New York per month is $ for minimum coverage, while full coverage costs an average of $ a month. How much is the average cost of car insurance in the U.S? The average cost for car insurance in the United States is $1, per year, or $ per month. Insurance companies consider a young driver to be anyone who is under 25 years old when rating for car insurance. So if you are between 16 and 24 and have a. The average annual cost of a minimum coverage car insurance policy for a brand new driver is approximately $1,, and roughly $2, annually for “full. In Calgary, the average cost of insurance for a new driver can range anywhere from $2, to $5, per year, depending on various factors such as age, driving.

Full coverage car insurance costs an average of $2, per year, while minimum coverage is $ per year. On a monthly basis, full coverage averages $, with. How much is car insurance for someone under 25? The average annual car insurance cost for a year-old in the United States is $3, This is 55% less. USAA offers discounts on car insurance for young drivers. Members can get a Auto Insurance for Teen Drivers. Help cut your teen's car insurance costs. That's why your rates will increase when you add your young driver to your car insurance policy. You can offset some of that cost by qualifying for some of the. State Farm offers competitive rates on car insurance for teen drivers. Not to mention excellent service, safe-driving tips, and savings as much as 25%. Planning on getting a new 23 corolla LE & so far been quoted about $ 6-month $ a month for full coverage I'm 22M so I know that's why. Although there's no specific answer, to most insurance companies, young drivers would typically include anyone who falls into the 16–year-old category. The average cost to add a year-old, newly licensed driver to an adult's existing auto insurance policy is about $ per month, according to Investopedia's. Car insurance companies see young male drivers as statistically more likely to take risks while driving than young female drivers. As such, the average cost of. Consistently, young drivers are disproportionately represented in auto Many insurers will not insure a driver whose recent driving record is poor. Millennial drivers, ages years old pay the most for auto insurance, as their average yearly premium of $2, This is comparable to Gen X drivers . Brand new drivers get a premium rate which is far less than normal class 5 insurance.. you could be looking at to kinda number depends. Car insurance can be one of the biggest expenses for new car drivers. Find out why it's so expensive and how to reduce the cost of insuring your car. In most cases though, it's generally cheaper to add your teenager to your household car insurance policy. While doing so will increase your insurance rates. These companies also offer several discounts for young drivers and students. How much does car insurance cost for a year-old driver? The overall average car. Yes, as a young driver you can get affordable car insurance, even if you're under the age of Age alone doesn't determine car insurance premiums. Erie: An average of $3, per year. Teen drivers purchasing a policy on their own may find the cheapest coverage with: Erie: An average of $2, per year. Sports cars and other high-performance vehicles usually cost more to insure. 2. Qualify for Teen Driver Discounts. Ask if your auto insurance company offers any. Most states require drivers to have auto liability insurance before they can legally drive, according to the Insurance Information Institute (III). New driver insurance is cover for people who have recently passed their test. It is the same as a standard car insurance policy but because younger drivers have.

203k Loan Refinancing

This mortgage product enables borrowers to finance the purchase or refinance of a home, along with its renovation or rehabilitation of their existing home. An FHA k loan is a Federally Insured Loan designed to help home buyers purchase a property that needs renovation or refinance an existing home with the goal. A Standard (k) Loan covers up to $, for the purchase price and repairs. The standard (k) covers major structural repairs, such as foundation repairs. Thinking of upgrading the home you live in and enjoying the benefits of refinancing at the same time? By consolidating the costs of home repairs into your. The Connecticut Housing Finance Authority (CHFA) offers FHA (k) Renovation Mortgage Programs. Discover the program's benefits, eligibility requirements. By providing affordable financing to acquire the property, as well as additional funds to improve the property, a (k) mortgage helps homebuyers who are. The k program is a great way to finance both the purchase (or refinancing) of a house and the cost of its rehabilitation through a single mortgage. A renovation mortgage finances both the purchase or refinance of a home, plus the cost of repairs, upgrades, or updates to the property, with one first. Yes, you can refinance your home with an FHA (k) loan. The percentage of your current mortgage that you'll be able to refinance will depend on your credit. This mortgage product enables borrowers to finance the purchase or refinance of a home, along with its renovation or rehabilitation of their existing home. An FHA k loan is a Federally Insured Loan designed to help home buyers purchase a property that needs renovation or refinance an existing home with the goal. A Standard (k) Loan covers up to $, for the purchase price and repairs. The standard (k) covers major structural repairs, such as foundation repairs. Thinking of upgrading the home you live in and enjoying the benefits of refinancing at the same time? By consolidating the costs of home repairs into your. The Connecticut Housing Finance Authority (CHFA) offers FHA (k) Renovation Mortgage Programs. Discover the program's benefits, eligibility requirements. By providing affordable financing to acquire the property, as well as additional funds to improve the property, a (k) mortgage helps homebuyers who are. The k program is a great way to finance both the purchase (or refinancing) of a house and the cost of its rehabilitation through a single mortgage. A renovation mortgage finances both the purchase or refinance of a home, plus the cost of repairs, upgrades, or updates to the property, with one first. Yes, you can refinance your home with an FHA (k) loan. The percentage of your current mortgage that you'll be able to refinance will depend on your credit.

April 23, - Private money lending is GREAT! I love the concept of being able to borrow money at % with 4 points, for a period of 6 months. After. Buying a Home with a FHA (k) Renovation Mortgage This program is ideal for buying a fixer upper, distressed property, or out of date home. It can also save. See our picks for top FHA (k) lenders. FHA (k) loans can help you buy and renovate a fixer-upper, or finance upgrades to your current home. FHA (k) loans allow buyers to finance both the purchase and rehabilitation of a home through one mortgage. Ready to renovate? This government-insured loan helps customer repair or remodel a primary residence at the time of purchase or refinance. Learn more here. A standard (K) loan allows homeowners to borrow a minimum of $5, for eligible improvements. To complete the transaction, all Minimum Property Standards . An FHA (k) loan is a renovation mortgage insured by the Federal Housing Administration (FHA). It allows homebuyers to finance the cost of repairs. A k loan is a special type of rehabilitation mortgage. Borrowers may use k loans to purchase, redevelop, or fix up a single-family home. Refinancing current mortgage loans into an FHA k loan is easy. To qualify, borrowers need a minimum credit score of (k) Rehabilitation Mortgage Insurance Program Types: Limited (k) Mortgage, Standard (k) Mortgage, Stages in the Process. FHA (k) loan lets you purchase or refinance and rehabilitate a property with one loan closing. An FHA k loan is a home construction loan. It was designed for people looking to finance both home improvements and a home purchase using only one loan. My thought is to get in the door with an FHA or K loan on a distressed property which we could refinance under a conventional (cash out or non cash out). Refinancing With A FHA k Loan can be done no matter what mortgage loan program you currently have. You can have a conventional loan, USDA Loan, VA Loan, or. What is a k loan? · The loan may be used for updating, modernization, or total renovation of your home. · You are able to combine renovation costs and first. NJ Lenders Corp is a Direct FHA k lender ready to help you navigate this unique program. There are many homes on the market that require some TLC. The FHA K construction or "rehab" loan enables homebuyers and homeowners to finance both the purchase (or refinancing) of a house and the cost of its. Consumers may not be aware that renovation loans, including the FHA Standard (k) Renovation Loan, can be used to refinance an existing mortgage. This can be. While the FHA k loan offers a unique opportunity to finance both the purchase and renovation of a property under a single mortgage, it's primarily designed.

Opening An Account

What you need to open a checking account · Your Social Security number. · A valid, government-issued photo ID like a driver's license, passport or state or. A bank is a place to put your money and keep it safe in an account. Banks offer many services, including. $12 or $0 Monthly Service Fee · A checking account that students can open on their own with tools like Account Alerts and Zelle® to help manage your money. Here's how to find a bank you trust, important aspects to consider when comparing account options, and even what documentation most establishments require. Open a bank account with Regions, you'll discover a full spectrum of accounts, products and services designed to meet your banking needs. Open an Account Online. Open an account online at any time, from anywhere. Choose from a personal checking, savings or money market account. Open a TD Checking Account online in minutes—it's easy and secure. With accounts built for every stage of life, you'll get free Online Banking. Opening a checking account is easier than ever, especially if you decide to apply online. Select your preferred checking accounts and compare accounts if you're. From checking and savings accounts to loans, opening your account online starts here. Select an account and we'll walk you through each step. What you need to open a checking account · Your Social Security number. · A valid, government-issued photo ID like a driver's license, passport or state or. A bank is a place to put your money and keep it safe in an account. Banks offer many services, including. $12 or $0 Monthly Service Fee · A checking account that students can open on their own with tools like Account Alerts and Zelle® to help manage your money. Here's how to find a bank you trust, important aspects to consider when comparing account options, and even what documentation most establishments require. Open a bank account with Regions, you'll discover a full spectrum of accounts, products and services designed to meet your banking needs. Open an Account Online. Open an account online at any time, from anywhere. Choose from a personal checking, savings or money market account. Open a TD Checking Account online in minutes—it's easy and secure. With accounts built for every stage of life, you'll get free Online Banking. Opening a checking account is easier than ever, especially if you decide to apply online. Select your preferred checking accounts and compare accounts if you're. From checking and savings accounts to loans, opening your account online starts here. Select an account and we'll walk you through each step.

Regions Bank checking accounts are designed with unique features to help make banking easier. Open a checking account online that best fits your needs. It takes just 3 steps to open a TreasuryDirect Account. Step 1: Choose the type of account you are opening. Step 2: Provide personal information. Ready to open a personal bank account? Apply online or find a Cape Cod 5 location near you to get started. Launch Checking. This account is a great way to get started with TBK Bank. The Launch checking account has a $0 minimum opening deposit, $0 monthly service. You can open a PNC checking account online or in person. You'll need: A U.S. government-issued photo ID such as a driver's license, a non-driving state. Welcome and thank you for choosing Middlesex Savings Bank. Enter ZIP Code and then tab to choose to either Open an Account or Return to a Saved Application. The interest they pay for savings accounts. You usually need to make an initial deposit between $25 and $ to open a savings or checking account. Tip. Find. What you need to open a checking account · Your Social Security number. · A valid, government-issued photo ID like a driver's license, passport or state or. To open a checking or savings account, you will need a valid state-issued ID, your SSN, and a computer or mobile device with a camera. Open a Schwab account online today to start saving, trading or investing. We offer brokerage, IRA, checking and Schwab Intelligent Portfolios online. Easily open a new account with Truist online today: checking, savings, loans and mortgages, credit cards, and more. To open a new checking account online, you'll enter basic information, such as your address and Social Security number and choose funding options. Explore checking account options designed to fit your changing needs. Open a Bank of America Advantage Banking account online today. The interest they pay for savings accounts. You usually need to make an initial deposit between $25 and $ to open a savings or checking account. Tip. Find. Account Details: · No minimum balance required. · No minimum deposit to open your account. · Fifth Third Extra Time ® gives you more time to make a deposit and. You can apply for a Citizens checking account online, over the phone, or at any Citizens branch. To apply online, just select the appropriate link from the top. Opening a new account online is quick and easy. All you need is: Your phone number, email address and U.S. residential address; Your date of birth and Social. Open a Schwab account online today to start saving, trading or investing. We offer brokerage, IRA, checking and Schwab Intelligent Portfolios online. Good news: Setting up a checking or savings account online can be quite simple and take mere minutes. Here's how to find a bank you trust, important aspects to consider when comparing account options, and even what documentation most establishments require.

1 2 3 4 5