yowordpress.ru Community

Community

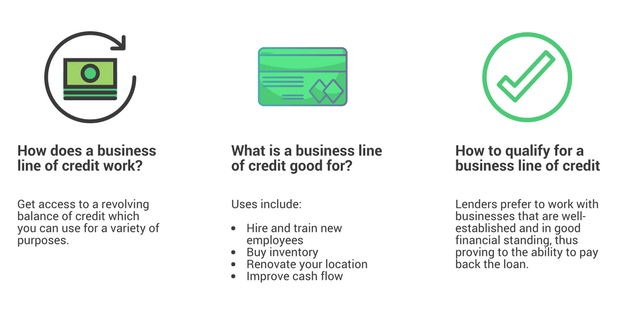

Best Business Line Of Credit Rates

OnDeck offers a business line of credit that allows you to withdraw what you need when your business needs it. Lines of credit from $6K - $K. Small Business Lending Rates are only available to loans originating through the Retail Community Bank channel. Origination and other fees may apply. Other loan. Business line of credit rates and fees. Current business line of credit rates can range from 10% to 99% APR. The interest rate you receive will vary based on. No Cost, No Obligation, Hour Approvals Same Day Funding. Get $10, to $2M Now! Get Started. A business line of credit is an unsecured or revolving loan. Learn about the factors to consider when choosing a business line of credit, compare current rates, and get tips for applying for one in Canada. A business line of credit can be a good idea, allowing you to borrow only what you need for short-term expenses and pay interest only on that sum. Compare the Best Business Lines of Credit ; American Express Business Line of Credit Best for Backed by American Express, %–% ; Lendio Business Line of. A business line of credit is a flexible financing option you can draw from as needed. Interest is only charged on the amount of money you borrow. Best for flexibility: Bluevine Business Line of Credit · Best from a big bank: Wells Fargo BusinessLine · Best secured line of credit: American Express® Business. OnDeck offers a business line of credit that allows you to withdraw what you need when your business needs it. Lines of credit from $6K - $K. Small Business Lending Rates are only available to loans originating through the Retail Community Bank channel. Origination and other fees may apply. Other loan. Business line of credit rates and fees. Current business line of credit rates can range from 10% to 99% APR. The interest rate you receive will vary based on. No Cost, No Obligation, Hour Approvals Same Day Funding. Get $10, to $2M Now! Get Started. A business line of credit is an unsecured or revolving loan. Learn about the factors to consider when choosing a business line of credit, compare current rates, and get tips for applying for one in Canada. A business line of credit can be a good idea, allowing you to borrow only what you need for short-term expenses and pay interest only on that sum. Compare the Best Business Lines of Credit ; American Express Business Line of Credit Best for Backed by American Express, %–% ; Lendio Business Line of. A business line of credit is a flexible financing option you can draw from as needed. Interest is only charged on the amount of money you borrow. Best for flexibility: Bluevine Business Line of Credit · Best from a big bank: Wells Fargo BusinessLine · Best secured line of credit: American Express® Business.

Alpine Bank offers some of the best small business line of credit choices in CO. $ annual fee; Five-year maturity on lines of credit greater than. Keep your business moving. · Lines from $, to $1 million · Revolving line of credit that renews annually · Interest-only monthly payments · % rate. A business checking line of credit (CLOC) is a credit product with a fixed rate of % APR. CLOC repayment terms are 2% of the outstanding balance or $ credit, good business credit, and a track record of generating business lines of credit typically have lower interest rates than business credit cards. For BusinessLine line of credit, your rate will be between Prime + % and Prime + % depending on your personal and business credit evaluation. Prime. Your line of credit can help you cover everyday business expenses. Borrow funds whenever you need them, up to your approved credit limit. Secured lines may offer lower interest rates depending on your business profile and credit history. What is Best For Your Business. Normal credit. Best for Businesses seeking an unsecured line of credit. · Line of credit amounts between $20, and $, · Loan application and decisioning process –. First Commonwealth Bank proudly offers top local banking solutions in our communities of Pennsylvania and Ohio, including banks in Altoona, Canton, Cincinnati. Note: Secured line of credit also available at competitive interest rates. What type of credit line is best for small business? Here's what to know. Apply for credit lines up to $, and only pay for what you use, with rates as low as % for top qualifying customers and no maintenance fees. 2. blue. All accounts must be in good standing. Based upon analysis of application, appraisal and origination fees, and interest rates, for competing U.S. lenders as. You can hire seasonal help or offer signing bonuses to attract top talent, update equipment or order supplies, or stock up on additional inventory when prices. Find the best business line of credit options available from U.S Bank, and Interest rates are typically lower than a line of credit; Interest is. No one knows your business better than you do. Our fixed- and variable-rate credit line options can help you grow your business, cover short-term cash flow. Preferred Rewards for Business members can get an interest rate discount of %% for new Business Advantage credit lines, term loans and secured lending. Flexible financing for your business · Business financing from $5, to $, · Terms from months · Monthly interest rate %** · Weekly or monthly. Popular Bank offers business loans and business lines of credit up to $ Talk to a banker to find the best business financing option for you. It's a great way to stabilize your cash flow and give you peace of mind. Lines of Credit rates are variable and subject to change daily based on. Cons of a Business Line of Credit. However, with Business Lines of Credit, you typically need good credit to qualify, and you may receive a higher interest rate.

How Much Do Dividend Stocks Pay

Companies usually pay dividends on a quarterly basis or semiannually, though it depends on the stock at hand how frequently (or not) this happens. You can find. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase. Consider a simplified example: for a company that pays a 2% annual dividend and whose shares are trading at $, an investor with shares would receive an. Investing With SoFi. Dividends — cash or stock rewards from a company to its shareholders—are typically paid quarterly to qualifying shareholders. These. How do you find the best dividend stocks to buy? Income investors know there's no substitute for regular dividend increases over the long haul. A dividend is an amount of money paid regularly by a company to its shareholders. Dividend stocks are popular among investors because they are typically. This metric—which is calculated by dividing dividends per share by earnings per share—tells you how much of a company's earnings are going toward the dividend. Think of your finances. If you constantly paid cash to family members, your net worth would decrease. It's no different for a company. Money that a company pays. Normally, companies pay cash dividends on a regular basis (often quarterly). Sometimes, they'll elect to pay a one-time dividend, as well. Stock dividends are. Companies usually pay dividends on a quarterly basis or semiannually, though it depends on the stock at hand how frequently (or not) this happens. You can find. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase. Consider a simplified example: for a company that pays a 2% annual dividend and whose shares are trading at $, an investor with shares would receive an. Investing With SoFi. Dividends — cash or stock rewards from a company to its shareholders—are typically paid quarterly to qualifying shareholders. These. How do you find the best dividend stocks to buy? Income investors know there's no substitute for regular dividend increases over the long haul. A dividend is an amount of money paid regularly by a company to its shareholders. Dividend stocks are popular among investors because they are typically. This metric—which is calculated by dividing dividends per share by earnings per share—tells you how much of a company's earnings are going toward the dividend. Think of your finances. If you constantly paid cash to family members, your net worth would decrease. It's no different for a company. Money that a company pays. Normally, companies pay cash dividends on a regular basis (often quarterly). Sometimes, they'll elect to pay a one-time dividend, as well. Stock dividends are.

Dividends can provide at least temporarily stable income and raise morale among shareholders, but are not guaranteed to continue. For the joint-stock company. Most dividend stocks pay out once or twice a year. However, there are a few stocks and funds that pay out cash every month, which investors can use to draw a. Plan participants can reinvest all or part of their Costco cash dividends to purchase additional shares (Dividend Reinvestment Plan). Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. See how they compare to other. How to calculate dividends · (annual dividend payments / annual net earnings) * = dividend payout ratio · (3M / 5M) * = 60% · year-end retained earnings –. MAIN: MAIN had a dividend yield of % and is paid $ per share. It also pays special dividend payments every quarter. PSEC: Prospect. At those dividend yields, you'd need a portfolio value between $, and $, to make $ per month in dividends. How much money do I need to invest to. These dividends are usually paid on a quarterly basis, although some companies may opt for a monthly, semiannual, or one-time lump-sum payment. Stock dividends. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. And. As far as monthly dividend stocks go, Main Street's regular payout works out to a solid %, and this does not include the special dividends. Main Street. Dividends are a type of payment used by companies to share profits with their shareholders. Dividends may be paid out on a monthly, quarterly, semi-annual or. Dividend-paying stocks may be appealing to many investors who are seeking yield. For example, retiring baby boomers who are searching for income-producing. Dividends are a percentage of profits that some companies pay regularly to shareholders. · A dividend provides investors income, which they can reinvest if they. The most comprehensive dividend stock destination on the web. Contains profiles, news, research, data, and ratings for thousands of dividend-paying stocks. It could seem like a good idea to buy shares of a stock or fund just in time to get the dividend payment—but in many cases, it's not. Qualified dividends are subject to long-term capital gains taxes, which are 15% for most investors. Most dividends paid by U.S. companies trading on U.S. Stable, reliable, safe—loads of investment commentary use words like these to describe dividend-paying stocks. Many experts make high-dividend stocks seem. Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company. Most companies pay quarterly dividends. For such companies, the annualized dividend per share = 4 x quarterly dividend per share. How To Calculate Dividend. Companies that pay out a portion of their profits as dividends are known as dividend stocks. This type of stock can serve as a reliable income stream;.

Good Small Businesses To Own

Equipment is the biggest outlay for launching a lawn care business, but if you start small, you'll need only a lawn mower and leaf blower. Depending on where. What's the best type of online business to start? What niches are most I like that Amazon seems to be geared towards small businesses and helping us out.”. 1. Website and app development · 2. Financial consulting · 3. Online business consulting · 4. Information security · 5. Digital marketing · 6. Social media marketing. “Retail” (16%), “Food and Restaurant” (13%), and “Health, Beauty, and Fitness Services” (12%) remain the top three leading industries among small businesses. That's why catering is one of the best businesses you can start with a small investment. Catering isn't only needed for birthdays and weddings. But they're also. What's the best type of online business to start? What niches are most I like that Amazon seems to be geared towards small businesses and helping us out.”. Small Town Business Ideas · Beauty Salon: Open a salon offering hair, nail, and beauty services. · Clothing Brand: Design and sell your own line of clothing. Dog walking can be a great side hustle for animal lovers. You can start by asking your neighbors or putting up local ads to let people know about your services. What do you need to start a small business? · Idea backed by market research · Business plan · Funding and bank account · Business structure (corporation, LLC, etc.). Equipment is the biggest outlay for launching a lawn care business, but if you start small, you'll need only a lawn mower and leaf blower. Depending on where. What's the best type of online business to start? What niches are most I like that Amazon seems to be geared towards small businesses and helping us out.”. 1. Website and app development · 2. Financial consulting · 3. Online business consulting · 4. Information security · 5. Digital marketing · 6. Social media marketing. “Retail” (16%), “Food and Restaurant” (13%), and “Health, Beauty, and Fitness Services” (12%) remain the top three leading industries among small businesses. That's why catering is one of the best businesses you can start with a small investment. Catering isn't only needed for birthdays and weddings. But they're also. What's the best type of online business to start? What niches are most I like that Amazon seems to be geared towards small businesses and helping us out.”. Small Town Business Ideas · Beauty Salon: Open a salon offering hair, nail, and beauty services. · Clothing Brand: Design and sell your own line of clothing. Dog walking can be a great side hustle for animal lovers. You can start by asking your neighbors or putting up local ads to let people know about your services. What do you need to start a small business? · Idea backed by market research · Business plan · Funding and bank account · Business structure (corporation, LLC, etc.).

Retail business ideas · Pet groomer. Americans spent more than $95 billion dollars on pets in , according to the American Pet Products Association, with pet. The Most In-Demand Small Business Ideas to Consider When Starting Your Business · 1. Social Media Management · 2. Freelance Writing · 3. Language Translation. well-received or the market for it is too small. Don't cling to a Running your own business is a journey unlike any other. Here are some tips. Another business opportunity for anyone who loves driving around town is to become a delivery driver. Companies like UberEats and DoorDash are always looking. Some of the best small businesses to start this year · 1. Cleaning services · 2. Dog walker · 3. Mobile car wash · 4. Tutoring · 5. Fitness and personal training · 6. Most businesses need sources of cash to stay afloat until they start making money. In order to avoid these common financial missteps, you need a well-researched. Hence, mobile garage service can be an innovative yet profitable small scale business idea. To promote the start up business, the owner can take the help of. Hence, mobile garage service can be an innovative yet profitable small scale business idea. To promote the start up business, the owner can take the help of. Most localities in Texas have resources for small businesses as well. Check with the economic development department nearest you to see how they can help. Try starting with our Intuit QuickBooks Online review — this vendor is our top pick for small businesses. Consider your funding options. Startup capital for. top low-cost startups With more and more people starting small businesses, the need for guidance when handling taxes is only increasing. Here are some great small business ideas to consider: 1> Online Tutoring: Offer subjects or skills you excel in through virtual platforms. If you want to start a new business, the Small Business Administration (SBA) can help. Top. Government information. All topics and services · Directory of. Investopedia periodically rates the best accounting software for small businesses. Many businesses today keep two sets of records: one physical and another in. Hence, mobile garage service can be an innovative yet profitable small scale business idea. To promote the start up business, the owner can take the help of. business ideas with low startup costs. Here are business ideas you can start with only a small financial investment: 1. Accounting and bookkeeping. Catering is a great small business idea for talented cooks or bakers. You don't need a whole restaurant. You can get by with a nice clean kitchen. And you. 1. Start with a Good Business Idea · Business consulting · Cleaning services · Tax preparation and bookkeeping · Event planning · Jewelry making · Copywriting. The most profitable business with minimal investment and time is often an online service-based business like freelance writing, graphic design. An event planning business can be a great free (or at the very least inexpensive) business to start; you primarily need a computer and capital to create a.

I Have Nobody In My Life

On “Lonely,” Akon wishes he had treated his girlfriend better after she leaves him. 1 K. My batteries get drained around people quickly. I get grumpy if I have to be around them too long." "I dislike a specific kind of person, like the irritating. It's natural to feel sad or lonely sometimes. It isn't normal for loneliness to lead to thoughts like “no one cares about me.” If you're feeling like no one. Don't censor yourself. Speak the way you would in real life. Wear the shirt your partner hates that you secretly love. Tell him to deal with it. Create. Nobody was there for me when I was at my lowest and darkest. I've learned that I shouldn't lower my standards merely to be with someone again. Lonely I have nobody for my own I'm so lonely Yo! This one here Goes out to all my players out there man, ya know That got that one good girl. Feeling lonely. Most people feel lonely sometimes, for many different reasons. If loneliness is affecting your life, there are things you. First off, I want you to know I really get that shit sucks right now. You may have lost your longtime partner, be at odds with a family. Hi all, I have just recently joined. Im 38, female, single and living alone. I've come to realise lately that although my family love me - On “Lonely,” Akon wishes he had treated his girlfriend better after she leaves him. 1 K. My batteries get drained around people quickly. I get grumpy if I have to be around them too long." "I dislike a specific kind of person, like the irritating. It's natural to feel sad or lonely sometimes. It isn't normal for loneliness to lead to thoughts like “no one cares about me.” If you're feeling like no one. Don't censor yourself. Speak the way you would in real life. Wear the shirt your partner hates that you secretly love. Tell him to deal with it. Create. Nobody was there for me when I was at my lowest and darkest. I've learned that I shouldn't lower my standards merely to be with someone again. Lonely I have nobody for my own I'm so lonely Yo! This one here Goes out to all my players out there man, ya know That got that one good girl. Feeling lonely. Most people feel lonely sometimes, for many different reasons. If loneliness is affecting your life, there are things you. First off, I want you to know I really get that shit sucks right now. You may have lost your longtime partner, be at odds with a family. Hi all, I have just recently joined. Im 38, female, single and living alone. I've come to realise lately that although my family love me -

So write and draw and build and play and dance and live only as you can.”–Neil Gaiman. I meet a lot of people in my work and travels and, as I have grown in my. Among people who want to build a social life, a sub-group with some unique fears are those who have no friends at all. The worries they have can be quite. I am here crying alone and lonely. I looked up bible verses about loneliness and it reminded me the Lord is with me all the time. It's just that when this. I used to think that everybody had their eye on me, watching my every move. That I was the one they thought of on their free time. Thinking of how bad I. I don't have any other family. I have no close friends, no husband or boyfriend, and no children. It's just me and my constant companions: emptiness, loneliness. Akon - Lonely (Letra e música para ouvir) - (Lonely) / (I'm Mr. Lonely) / (I have nobody) / (For my own). I think about entrepreneurship in broad terms — as more a life idea than a business one. Jim Collins has said that people who lead entrepreneurial lives. If you've ever asked yourself "Why does nobody like me?" you're not alone. Read this post to find out why and what to do about it. The story of the last years that changed the course of my life forever. This is my story of surrender and becoming nobody. i have noticed recently that nobody ever stays, ever, i cannot think of anybody that will stay, it is not that they have had to always go but often it is. Akon - Lonely (Lyric Video) | I have nobody for my own #lonely #akon #lyrics Click to enjoy the best relaxing music. Feeling lost in life? This guide gives 12 practical tips you can use to stop feeling lost and start winning the game of life. I miss my mum a lot I have nobody without her in my life now. 1 yr. 1. Rutz Mo. Lost my mom in to cancer. My life will. Ever be the same. Sometimes we feel like we don't. The emotional scars we have from experiencing trauma and living with emotional pain— from being rejected, ignored, or alone—. i have noticed recently that nobody ever stays, ever, i cannot think of anybody that will stay, it is not that they have had to always go but often it is. Has something so horrible ever happened to you that made you think, “Fuck, this is the worst moment of my life”? Has life ever thrown at you a bag of lemons. Oh, I don't know the two in the article, but I know life and I know human beings well enough to know that their life isn't nearly as perfect as it appears on. What does one need to do to not feel lonely? One popular answer is friends. People say that if you have really good friends (which I have the. Sometimes, it's easy to feel that nobody cares about you. Even the most popular and famous people have doubts about whether or not people close to them.

Wallstreetbets Next Stock

r/wallstreetbets, also known as WallStreetBets or WSB, is a subreddit where participants discuss stock and option trading. It has become notable for its. The full WallStreetBets most mentioned stocks list, over the last 24 hours. Check out the WallStreetBets Fear & Greed Index to view generalized sentiment in. Apewisdom tracks the most popular stock and crypto sub reddits such as wallstreetbets and tracks how many times certain stock tickers are used. r/wallstreetbets logo. r/stocks. on reddit. r stocks is the stock market reddit Community to share up and coming Canadian Penny Stocks also cause. That's something I watch for with stocks on the 50d on the 1hr chart. The first break above is rarely successful. Especially with a heavy short stock. The more. Weekend Wall Street chart This market's chart. This is a visual Stock index definition How to trade index futures Indices trading definition. You. Most Mentioned Stocks on WallStreetBets ; NVDA. Mentions ; AVGO. Mentions ; WAY. Mentions ; QQQ. 53 Mentions ; ASTS. 53 Mentions. YoloStocks | Real Time Meme Stocks Tracker | WallStreetBets Data ; 11, VEGA, VOO, GME, AMD ; 12, TSLA, TLT, SPX, VOO. Track which stocks are currently trending on WallStreetBets, and find historical data for any ticker. r/wallstreetbets, also known as WallStreetBets or WSB, is a subreddit where participants discuss stock and option trading. It has become notable for its. The full WallStreetBets most mentioned stocks list, over the last 24 hours. Check out the WallStreetBets Fear & Greed Index to view generalized sentiment in. Apewisdom tracks the most popular stock and crypto sub reddits such as wallstreetbets and tracks how many times certain stock tickers are used. r/wallstreetbets logo. r/stocks. on reddit. r stocks is the stock market reddit Community to share up and coming Canadian Penny Stocks also cause. That's something I watch for with stocks on the 50d on the 1hr chart. The first break above is rarely successful. Especially with a heavy short stock. The more. Weekend Wall Street chart This market's chart. This is a visual Stock index definition How to trade index futures Indices trading definition. You. Most Mentioned Stocks on WallStreetBets ; NVDA. Mentions ; AVGO. Mentions ; WAY. Mentions ; QQQ. 53 Mentions ; ASTS. 53 Mentions. YoloStocks | Real Time Meme Stocks Tracker | WallStreetBets Data ; 11, VEGA, VOO, GME, AMD ; 12, TSLA, TLT, SPX, VOO. Track which stocks are currently trending on WallStreetBets, and find historical data for any ticker.

Americans felt that Wall Street always had a way of coming out on top due to If you decide to choose a wallstreetbets stock to trade with CFDs. Which public company will WallStreetBets target next? View which public companies are getting the most mentions on /r/WallStreetBets. Let's break it down, Queen Lana-style. First things first, r/wallstreetbets – aka WSB – is not your grandpa's stock market forum. It started. stock market is trading just coming quarters, making certain technology stocks more attractive than ever. These stocks have gained the favor of Wall. Top WallStreetBets Stocks in the past 24 hours · NVIDIA · SPDR S&P ETF · Broadcom · Tesla · Reddit · Intel · Invesco QQQ · AST SpaceMobile. Palantir Technologies's stock price is currently $, and its average month price target is $ Subreddit r/WallStreetBets has been the talk of the Internet this week, as its members have driven GameStop's stock prices from around $20 to over $ WSB (WallStreetBets) is a Reddit community of investors and traders who follow the stock market. The WSB list includes stocks that receive a lot of media. Some examples are r/WallStreetBets, r/Stocks, r/Investing and r/PennyStocks. Reddit is also planning an IPO, and there are rumors that the next Reddit. Next Cryptos to Explode. Industries to Related Articles. happy traders wall street celebrating profit growth win. Billionaires Are Selling Nvidia Stock. The Roaring Kitty channel revolves around educational live streams where I share my daily routine of tracking stocks and performing investment research. Latest WallStreetBets Stocks Earnings ; 7/30/, Q2 Advanced Micro Devices, Inc. stock logo. AMD. Advanced Micro Devices ; 7/30/, Q2 SoFi. PFE is Wallstreetbets Next target! Daily Slice Stock Market News Aug 23, View top meme stocks. We use our data on WallStreetBets discussion and fails-to-deliver to generate a proprietary “Meme Score” for publicly traded. Register and follow to be notified the next time content from Wallstreetbets is published. Are Hong Kong's financial regulators monitoring the stock exchange. Explore SNDL Inc. (SNDL) trends on wallstreetbets, highlighting its potential as a next meme stock. Check if SNDL ranks among the best meme stocks today. Dividend stocks should do well in a declining interest rate environment. Sit back and let dividends do the heavy lifting for a simple, steady path to serious. Earnings are the driver of stock prices and the right earnings information can help longer-term investors significantly outperform the overall stock market. Earnings calendar, dividends, stock splits, investor conferences, mergers and acquisitions, and more corporate event data for institutional traders and. WallStreetBets (stock and crypto). . Public group. . 32K members · Join group Access: The Next Beneficiaries of the AI Revolution – Best Growth Stocks.

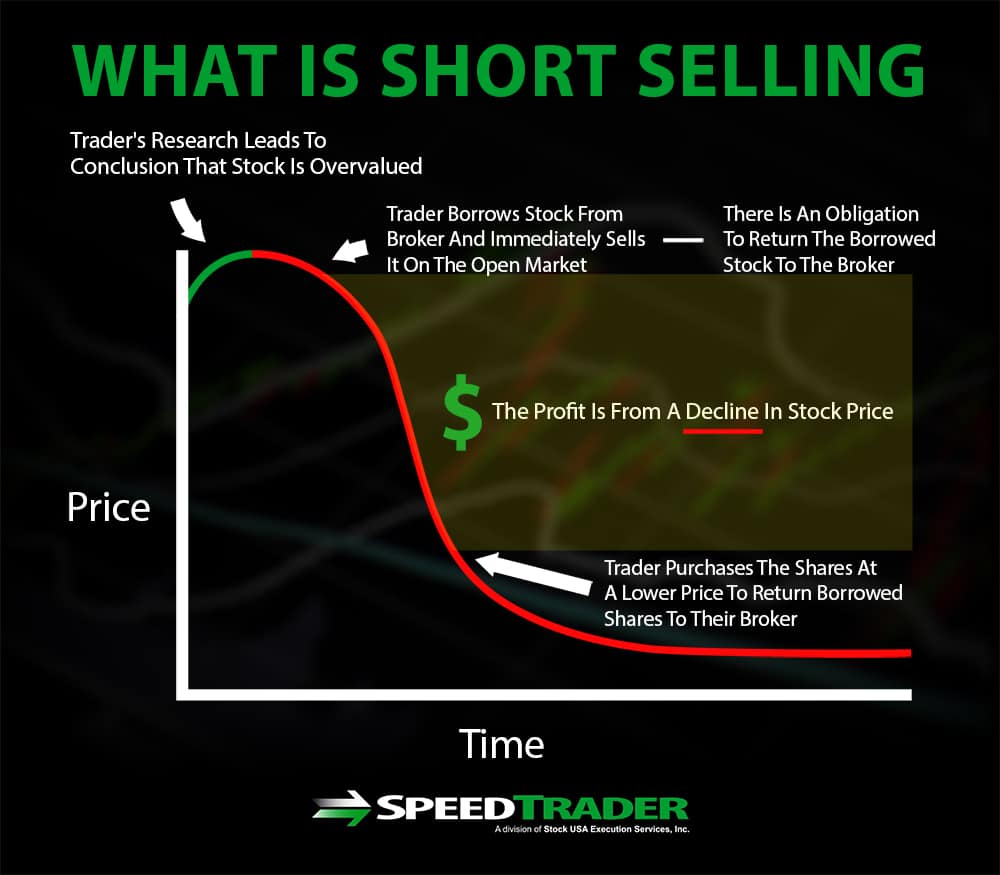

What Is Short Selling In Share Market

Short selling is the selling of a stock that the seller doesn't own. More specifically, a short sale is the sale of a security that isn't owned by the seller. To take a short position, investors will borrow the shares from a stockbroker or investment bank and quickly sell them on the stock market at the current market. Short selling is a strategy for making money on stocks falling in price, also called “going short” or “shorting.” This is an advanced strategy only. Investing and owning physical shares, as well as long trading positions, have increased potential of profit in bull markets. Short selling – which is also. Then, the investor quickly sells the shares to a buyer at the current market price. The investor then waits for the price of the stock to decrease. If (and it's. Short sellers identify shares or markets that they think might be poised for a downswing. Shorting stocks can help traders to hedge against any potential. Investors who sell short believe the price of the stock will decrease in value. If the price drops, you can buy the stock at the lower price and make a profit. The traditional approach to trading in the stock market and making a profit out of it is through "buying low and selling high", also known as a long position. Short selling promotes liquidity, stabilizes the market, and helps investors and companies reduce risk in their portfolios. Short selling is the selling of a stock that the seller doesn't own. More specifically, a short sale is the sale of a security that isn't owned by the seller. To take a short position, investors will borrow the shares from a stockbroker or investment bank and quickly sell them on the stock market at the current market. Short selling is a strategy for making money on stocks falling in price, also called “going short” or “shorting.” This is an advanced strategy only. Investing and owning physical shares, as well as long trading positions, have increased potential of profit in bull markets. Short selling – which is also. Then, the investor quickly sells the shares to a buyer at the current market price. The investor then waits for the price of the stock to decrease. If (and it's. Short sellers identify shares or markets that they think might be poised for a downswing. Shorting stocks can help traders to hedge against any potential. Investors who sell short believe the price of the stock will decrease in value. If the price drops, you can buy the stock at the lower price and make a profit. The traditional approach to trading in the stock market and making a profit out of it is through "buying low and selling high", also known as a long position. Short selling promotes liquidity, stabilizes the market, and helps investors and companies reduce risk in their portfolios.

Short selling is a trading strategy that allows traders to profit from a declining stock price. Essentially, it involves borrowing shares of a company from a. Short selling means that you expect the price of a stock to fall, then you sell some borrowed shares Reliable market signals for short selling may include. Short selling” is a controversial subject amongst investors because it seeks to profit from a fall in the company's share price. A short sale generally involves the sale of a stock you do not own (or that you will borrow for delivery). Short sellers believe the price of the stock will. Selling short is a trading strategy for down markets, but there are risks, particulary for naked positions. Sophisticated investors with a bearish view of the market will often use short sales to profit from falling share prices. Short positions also help. (Short selling involves borrowing a security whose price you think is going to fall from your brokerage and selling it on the open market. Your plan is to then. In the stock market, a short sale is made to earn profits in a short period. Some believe it is similar to owning stocks for a more extended period. Long-term. Going Short – What is Short Selling? The term “Short Selling” originated in the stock market. A while back, a person borrowed stocks from his broker in order. Short Selling is only allowed in intraday trading. What is short selling in the stock market? Contrary to investors who intend to hold stocks long-term, hoping. The most basic is physical selling short or short-selling, by which the short seller borrows an asset (often a security such as a share of stock or a bond) and. Choose a stock to sell using analysis · Open a position to 'sell' the stock – either via your broker or with a derivative · Monitor the market · Buy the shares. Buying stocks on a Long Position is the action of purchasing shares of stock(s) anticipating the stock's value will rise over time. Short selling requires you to be aware of a share's market price while making the trade and have a high-risk tolerance because of the potential for unlimited. In most cases, their strategies keep markets more efficient and spreads tighter – without having a directional or long-term view on the stock. That, in turn. Short selling aims to profit from a pending downturn in a stock or the stock market. It corresponds to the trader's mantra to “buy low, sell high,” except it. Short selling is an investment strategy where an investor borrows shares of stock from a broker and sells them in the market, hoping the price will fall. They. Let's assume that shares of the N company are trading at $, but you expect them to decrease in value and make the decision to short-sell the stock. You. For example, you just sold shares of Company Z at the current market price of $90 per share. Just like any other time when you sell stock, the money from. Well, in times of market turmoil, there are still opportunities to generate returns from stocks. The process is called short selling (or shorting shares of.

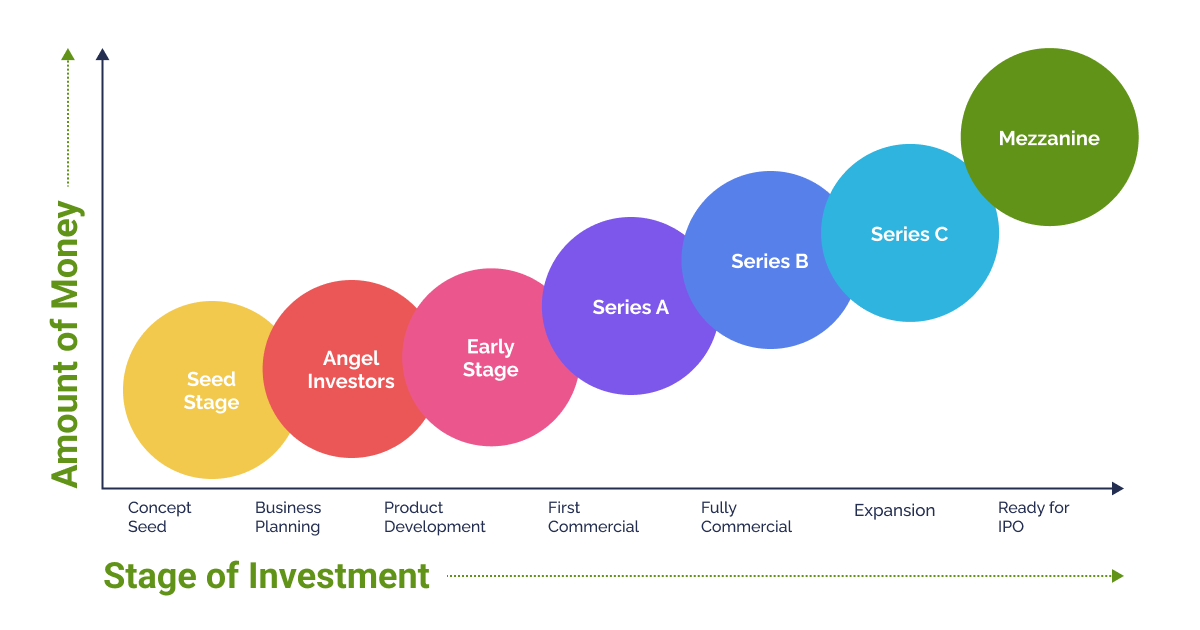

What Are Series Funding Rounds

Series E funding is the fifth major round of fundraising that a startup might go through. This round occurs late in the fundraising process. Finnish SAR data provider ICEYE has successfully concluded a Series D funding round, raising $ million. The round was led by Seraphim Space. Series funding is a multi-round process in which startup companies receive money from external investors in exchange for equity, or ownership over part of their. Series A funding is the stage of a funding round that comes in when a company has already established itself in the market and customers have begun to. The rounds of venture capital include pre-seed, seed, Series A, Series B, Series C, and sometimes Series D. Each round represents a different level of company. A funding round occurs when a startup seeks to raise capital from either new or existing investors; it concludes when said transaction is complete. While a Series A funding round is to really get the team and product developed, a Series B Funding round is all about taking the business to the next level. Series A funding is meant to last between six months and two years to guide development. Business owners need a clear plan for how much money they will need in. When a company reaches Series A, it must clearly indicate a precise product-market fit, though it may not be profitable. The primary goal of this funding round. Series E funding is the fifth major round of fundraising that a startup might go through. This round occurs late in the fundraising process. Finnish SAR data provider ICEYE has successfully concluded a Series D funding round, raising $ million. The round was led by Seraphim Space. Series funding is a multi-round process in which startup companies receive money from external investors in exchange for equity, or ownership over part of their. Series A funding is the stage of a funding round that comes in when a company has already established itself in the market and customers have begun to. The rounds of venture capital include pre-seed, seed, Series A, Series B, Series C, and sometimes Series D. Each round represents a different level of company. A funding round occurs when a startup seeks to raise capital from either new or existing investors; it concludes when said transaction is complete. While a Series A funding round is to really get the team and product developed, a Series B Funding round is all about taking the business to the next level. Series A funding is meant to last between six months and two years to guide development. Business owners need a clear plan for how much money they will need in. When a company reaches Series A, it must clearly indicate a precise product-market fit, though it may not be profitable. The primary goal of this funding round.

Understanding Series Funding Startup pitches their idea in various venture capital fund houses in several rounds. Investors assess their idea in many stages. Series A funding is the next round of financing that startups usually receive after the seed funding stage. Essentially, the series A round is the second stage of startup financing and the first stage of venture capital financing. Similar to seed financing, series A. What are funding rounds? Fundraising rounds are about securing the right amount of capital to support your startup. Generally speaking, between seed and exit. Startup funding explained: Series A, Series B, Series C Once a startup is seeded, it can participate in Series funding rounds to generate additional funding. Series B funding is the round at which you've proven not just the strength of your product-market fit but also the ability to scale your business model and. Series A funding or “series A investment” is the second stage in the funding process a startup goes through. Series A rounds come after seed funding. Series A funding is a type of equity-based financing that is considered the first major round of external funding startups can raise. The investment size for a Series A round can vary significantly, typically ranging from $2 million to $15 million. Why Raise a Series A? Series A funding is. A funding round is any time you raise money from one or more investors. They are labeled A, B, C, etc. because they happen in a series. In a Series B funding round, the investment is typically led by venture capital firms and may include participation from existing investors as. A series A is the name typically given to a company's first significant round of venture capital financing. It can be followed by the word round, investment. As you've probably guessed, a series B round is the second round of funding by private equity investors and VCs. By this stage, the company will probably have a. Venture capital firms are the Series A round's biggest investors. These firms specialize in investments intended for early-stage companies. Generally, the. the investor is a private equity, growth equity, VC and/or corporate. Not every $M+ round is GE round. It could be self-reported as Series A,B,C+ etc. Series B rounds help founders grow businesses past the development stage. Companies that have gone through seed and Series A funding rounds have already. Series A is the subsequent funding round after your initial seed funding round. You might need more money to continue developing the business and to employ more. The former case is the first time the investors get money out. If it grew, everyone makes out big. The Series A investors make the most, since. Series A financing refers to an investment in a privately-held start-up company after it has shown progress in building its business model. Series A is the subsequent funding round after your initial seed funding round. You might need more money to continue developing the business and to employ more.

1 2 3 4 5