yowordpress.ru Prices

Prices

England Power Of Attorney

Giving someone power of attorney means that you give another person the right to make decisions about your care and welfare. This is called a health and welfare. A lasting power of attorney is a legal document that allows you to appoint one or more people to make decisions on your behalf during your lifetime. Read about putting in place a power of attorney, which can give you peace of mind that someone you trust is in charge of your affairs. [English] - [Cymraeg] A lasting power of attorney (LPA) allows you to nominate someone you trust, known as an attorney, to step in if you lose the mental. A lasting power of attorney (LPA) for health and welfare is a legal document that lets you give someone you trust the power to make decisions for you. What POA powers are there in England & Wales? When someone makes a power of attorney, they appoint someone else to act on their behalf. The person making the power of attorney is called a donor and the. A Power of Attorney is a legal document that lets you appoint or more people to act on your behalf. This gives you more control if you lose the mental or. You can make a power of attorney only if you have mental capacity. This means you must be capable of making decisions for yourself. Giving someone power of attorney means that you give another person the right to make decisions about your care and welfare. This is called a health and welfare. A lasting power of attorney is a legal document that allows you to appoint one or more people to make decisions on your behalf during your lifetime. Read about putting in place a power of attorney, which can give you peace of mind that someone you trust is in charge of your affairs. [English] - [Cymraeg] A lasting power of attorney (LPA) allows you to nominate someone you trust, known as an attorney, to step in if you lose the mental. A lasting power of attorney (LPA) for health and welfare is a legal document that lets you give someone you trust the power to make decisions for you. What POA powers are there in England & Wales? When someone makes a power of attorney, they appoint someone else to act on their behalf. The person making the power of attorney is called a donor and the. A Power of Attorney is a legal document that lets you appoint or more people to act on your behalf. This gives you more control if you lose the mental or. You can make a power of attorney only if you have mental capacity. This means you must be capable of making decisions for yourself.

A power of attorney can be used to prepare for the future if your ability to manage your own affairs is decreasing. A solicitor can help to make your wishes to. If you lose the ability to make certain decisions, a lasting power of attorney (LPA), keeps those decisions with the people you trust. An LPA makes it easier. It enables you to choose a person/ or people (called an attorney) to deal with your property and affairs. A Power of Attorney ceases when you become mentally. As attorney you will have the right to deal with banks, building societies, adult social care and other organisations as necessary on behalf of the person. You can make decisions on someone's behalf if they appoint you using a lasting power of attorney (LPA). power of attorney governed by the Powers of Attorney Act , pursuant to which a person (the ; donor) appoints another person (the ; attorney) to act on the. A Lasting Power of Attorney is a legal document enabling a person aged over 18 and with all their mental faculties, to choose another person, or people, to. A lasting power of attorney (LPA) is a legal document which allows individuals to give people they trust the authority to manage their affairs. There's more information about LPAs on pages Enduring power of attorney (EPA). An EPA is only for financial decisions, but you can no longer set. A power of attorney (POA) is a legal document that allows a donor to put someone they trust in charge of any important decisions. A Lasting power of attorney (LPA) is a legal tool that lets you choose someone you trust to make decisions for you. A lasting power of attorney (LPA) gives someone else the authority to help you make decisions, or to make them on your behalf if you lose mental capacity. Product description. A Power of Attorney allows a relative or friend to be able to legally deal with your affairs. Lawpack's step-by-step Kit helps you to. Austrian Lasting Power of Attorney. An Austrian Lasting Power of Attorney needs to be drawn up before a Notary, lawyer or adult protection association and. Mental capacity is the ability to make a specific decision at the time that it needs to be made. Your LPA is made under the law of England and Wales. If you. Power of attorney is a legal document where one person (the donor) gives another the right to make decisions on their behalf. You can only set up a Power of. Making a lasting power of attorney (England and Wales) You need to be aged over 18 to set up a lasting power of attorney (LPA). You must also be able to make. The 'granter' (same as donor in the UK) can allow 1 or more people (the 'attorneys') to make decisions about their money or property. They can also set up a. A special form of agency by which a person gives another the power to act on their behalf and in their name. In England, a Lasting Power of Attorney (LPA) covers decisions about your financial affairs, or your health and welfare. These are two separate power of.

Nas Queensbridge Venture Partners

Queensbridge Venture Partners, LLC operates as a venture capital firm. Executives. Name/Title. Nasir Jones "Nas". PRESENT. Partner · Dee Murthy. PRESENT. EBONY CEO Michele Ghee and Nas talk generational wealth, and how he is building a lasting legacy through QueensBridge Venture Partners—his investment. Nas has quietly metamorphosed into a prolific angel investor — founding the venture capital firm QueensBridge Venture Partners. 4/ Nas is a founding member of QueensBridge Venture Partners (named after his hometown of Queensbridge), a tech venture capital fund. Through his Queensbridge Venture Partners, he's invested in more than companies and has become a multi-millionaire in his own right. Ben Horowitz from Andreessen Horowitz encouraged Nas to open his own VC firm. As a result, in Nas becomes a founding member of QueensBridge Venture. QueensBridge Venture Partners wasn't just a side hustle; it was a strategic move. Nas and his team weren't just tossing money around — they were. Queensbridge Venture Partners, LLC (QVP) is a venture capital firm founded by the renowned American rapper Nasir "Nas" Jones. Nas Jones is Partner at Queensbridge Venture Partners LLC. See Nas Jones's compensation, career history, education, & memberships. Queensbridge Venture Partners, LLC operates as a venture capital firm. Executives. Name/Title. Nasir Jones "Nas". PRESENT. Partner · Dee Murthy. PRESENT. EBONY CEO Michele Ghee and Nas talk generational wealth, and how he is building a lasting legacy through QueensBridge Venture Partners—his investment. Nas has quietly metamorphosed into a prolific angel investor — founding the venture capital firm QueensBridge Venture Partners. 4/ Nas is a founding member of QueensBridge Venture Partners (named after his hometown of Queensbridge), a tech venture capital fund. Through his Queensbridge Venture Partners, he's invested in more than companies and has become a multi-millionaire in his own right. Ben Horowitz from Andreessen Horowitz encouraged Nas to open his own VC firm. As a result, in Nas becomes a founding member of QueensBridge Venture. QueensBridge Venture Partners wasn't just a side hustle; it was a strategic move. Nas and his team weren't just tossing money around — they were. Queensbridge Venture Partners, LLC (QVP) is a venture capital firm founded by the renowned American rapper Nasir "Nas" Jones. Nas Jones is Partner at Queensbridge Venture Partners LLC. See Nas Jones's compensation, career history, education, & memberships.

It begins with an exploration of Nas's journey from a renowned hip-hop artist to a shrewd investor and co-founder of Queensbridge Venture Partners, drawing. Queensbridge Prism, Uncle Sam Loves Me, Humble Beginnings, Queensbridge Partners. Employee. Queensbridge Venture Partners, Uncle Sam Loves Me, Queensbridge. Nasir Jones has 3 current jobs including Partner and Co-Founder at QueensBridge Venture Partners, Partner at Emagen Investment Group Inc., and Partner at Uncle. Rapper Nas, American Rapper Nas is a successful angel investor who founded the venture capital firm Queensbridge Venture Partners. The business invests in a. Nasir Jones General Information. Description. Mr. Nasir Jones is the Founder of QueensBridge Venture Partners. He previously co-owned Sweet Chick. Mr. Nasir Jones is the Founder of QueensBridge Venture Partners. He previously co-owned Sweet Chick. He also served as Advisor at Sports Icon. Nas, the poetic sage of the Queensbridge projects, was hailed as the startup ViralGains another addition to Queens-bridge venture partners portfolio. Nas' venture capital firm, Queensbridge Venture Partners, has invested in several companies such Dropbox, SeatGeek, PlutoTV, and RobinHood. In an interview. Nas's entrepreneurial spirit extends beyond music, as he has ventured into various industries, including technology, fashion, and venture capital. His business. QueensBridge Venture Partners is a Venture Capital fund founded in It's primarily based out of Los Angeles, United States. QueensBridge Venture Partners is a Los Angeles based venture capital firm founded by Nasir "Nas" Jones, Anthony Saleh, Ajay Relan, Dee Murthy, Anand Murthy. Queensbridge Venture Partners is a venture capital firm. · MBIQ Supermarket flips. · BELLY, Directed By Hype Williams, Starring DMX and Nas. The multiplatinum artist and his business manager Anthony Selah, along with four other managing partners have created a venture capital portfolio by investing. Pluto TV is a company that Nas' Queensbridge Venture Partners invested in in Meaning, this is a good week financially for Nas. The rapper's investment. Nas, has emerged as an unlikely winner in today's Coinbase IPO. An early Jones' QueensBridge Venture Partners was an early backer of Coinbase. QueensBridge Venture Partners has a history of engaging in highly competitive and visible markets People. Nasir "Nas" Jones, Partner. View Website. Send. Nas is also a prominent tech investor? Through his venture firm, Queensbridge Venture Partners, the hip hop legend made an. That means that the rest of the $10M that QueensBridge invested could have all gone to zero and the fund as a whole would still be relatively. Nas's entrepreneurial spirit extends beyond music, as he has ventured into various industries, including technology, fashion, and venture capital. His business. Prior to WndrCo, Anthony served as Founder and Partner of Queensbridge Venture Partners, where he established and managed a $20 million fund that invested in.

Avgo Stock Price Today

View the real-time AVGO price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Performance ; Broadcom (AVGO). , ; BSE Sensex. , ; S&P , 50 minutes ago. Stock analysis for Broadcom Inc (AVGO:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Broadcom (AVGO) Stock Price & Analysis ; Price to Book (P/B) ; Price to Sales (P/S) ; Price to Cash Flow (P/CF) ; P/FCF Ratio ; Enterprise Value. AVGO Logo, Broadcom (AVGO) Stock Price Today: $ (%) The closing share price for Broadcom (AVGO) stock was $ for Friday, September The current price of AVGO is USD — it has decreased by −% in the past 24 hours. Watch Broadcom Inc. stock price performance more closely on the. Broadcom Inc ; SYMBOL:AVGO ; SECTOR:Technology ; DERIVED:CFD. i ; Open. ; Previous Close. Find the latest Broadcom Inc. (AVGO) stock quote, history, news and other vital information to help you with your stock trading and investing. View the real-time AVGO price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Performance ; Broadcom (AVGO). , ; BSE Sensex. , ; S&P , 50 minutes ago. Stock analysis for Broadcom Inc (AVGO:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Broadcom (AVGO) Stock Price & Analysis ; Price to Book (P/B) ; Price to Sales (P/S) ; Price to Cash Flow (P/CF) ; P/FCF Ratio ; Enterprise Value. AVGO Logo, Broadcom (AVGO) Stock Price Today: $ (%) The closing share price for Broadcom (AVGO) stock was $ for Friday, September The current price of AVGO is USD — it has decreased by −% in the past 24 hours. Watch Broadcom Inc. stock price performance more closely on the. Broadcom Inc ; SYMBOL:AVGO ; SECTOR:Technology ; DERIVED:CFD. i ; Open. ; Previous Close. Find the latest Broadcom Inc. (AVGO) stock quote, history, news and other vital information to help you with your stock trading and investing.

AVGO (Common Stock) ; Price, , Change ; Volume, 76,,, % Change ; 52 Week High, , Intraday High ; Intraday Low, , 52 Week Low. View the real-time AVGO price chart on Robinhood and decide if you want to buy or sell commission Broadcom Shares Are Trading Lower Today: What You Need To. What is Broadcom stock price doing today? As of September 5, , AVGO stock price declined to $ with 21,, million shares trading. What is. Broadcom Inc (NASDAQ:AVGO) stock price today is $, and today's volume is 18,, AVGO is up % today. The 30 day average volume is 35,, Discover real-time Broadcom Inc. Common Stock (AVGO) stock prices, quotes Today's High/Low. $/$ Share Volume. 76,, Average. Get Broadcom Inc (yowordpress.ru) real-time stock quotes, news, price and financial Today's Range: - 52 Week Range: - Profile. Historical Prices for Broadcom ; 09/03/24, , , , ; 08/30/24, , , , AVGO Stock Price ; EPS (FWD). ; PE (FWD). ; Div Rate (FWD). $ ; Yield (FWD). % ; Short Interest. %. Broadcom Inc is listed in the Semiconductor,related Device sector of the NASDAQ with ticker AVGO. The last closing price for Broadcom was $ Over the last. Broadcom | AVGOStock Price | Live Quote | Historical Chart ; US, , , % ; USND, , , %. Broadcom Inc stock price live, this page displays NASDAQ AVGO stock exchange data. View the AVGO premarket stock price ahead of the market session. Broadcom Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Based on 23 Wall Street analysts offering 12 month price targets for Broadcom in the last 3 months. The average price target is $ with a high forecast of. Quote Overview ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: ; 20 Day Avg Vol: 23,, Broadcom Inc Frequently Asked Questions · What is Broadcom Inc(AVGO)'s stock price today? The current price of AVGO is $ · When is next earnings date of. Stock prices may also move more quickly in this environment. Investors who Register for your free account today at yowordpress.ru Nasdaq link. In depth view into AVGO (Broadcom) stock including the latest price, news, dividend history, earnings information and financials. Track Broadcom Inc (AVGO) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. Key Stock Data · P/E Ratio (TTM). (09/06/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. B · Public Float. B · Yield. %. (NASDAQ: AVGO) Broadcom stock price per share is $ today (as of Sep 6, ). What is Broadcom's Market Cap?

What Does A Fidelity Bond Cover

Fidelity bonds protect your business against employee theft. If one or more of your employees is entrusted to handle cash or other valuable assets, you should. Generally speaking, fidelity bonds can provide two types of coverage: 1st party coverage and 3rd party coverage. 1st party coverage protects businesses from. Fidelity bonds are essentially a form of insurance against illegal acts. The coverage required by the Employee Retirement Income Security Act (ERISA) is. Fidelity bonds protect an employer from employee theft. With a fidelity bond, the employer guarantees money and property from damage by an employee's negligent. In some ways, they are more like insurance than typical surety bonds. This is because a fidelity bond is more of a 2-party agreement (as opposed to 3, in surety). An Employee Retirement Income Security Act (ERISA) fidelity bond is a type of insurance that protects the assets of employee benefit plans against losses caused. A fidelity bond is a form of insurance protection which covers losses that the policyholder incurs as a result of fraudulent acts by individuals. These bonds are a form of insurance that covers losses from an employee plan resulting from illegal acts such as theft and fraud. Need Business Insurance? A fidelity bond is a special type of insurance that protects plan participants from the risk of loss due to acts of fraud or dishonesty by plan officials. Fidelity bonds protect your business against employee theft. If one or more of your employees is entrusted to handle cash or other valuable assets, you should. Generally speaking, fidelity bonds can provide two types of coverage: 1st party coverage and 3rd party coverage. 1st party coverage protects businesses from. Fidelity bonds are essentially a form of insurance against illegal acts. The coverage required by the Employee Retirement Income Security Act (ERISA) is. Fidelity bonds protect an employer from employee theft. With a fidelity bond, the employer guarantees money and property from damage by an employee's negligent. In some ways, they are more like insurance than typical surety bonds. This is because a fidelity bond is more of a 2-party agreement (as opposed to 3, in surety). An Employee Retirement Income Security Act (ERISA) fidelity bond is a type of insurance that protects the assets of employee benefit plans against losses caused. A fidelity bond is a form of insurance protection which covers losses that the policyholder incurs as a result of fraudulent acts by individuals. These bonds are a form of insurance that covers losses from an employee plan resulting from illegal acts such as theft and fraud. Need Business Insurance? A fidelity bond is a special type of insurance that protects plan participants from the risk of loss due to acts of fraud or dishonesty by plan officials.

Bond insurance coverage ranges from $5, to $25, for a six-month period. As an incentive to hire members of a targeted population, employers receive the. Although the statute calls it a fidelity bond, associations will actually purchase an insurance policy that covers employee dishonesty (fidelity) plus non-. The fidelity bond definition is similar to a traditional insurance policy, however fidelity bonds tend to ensure a business against fraudulent or dishonest acts. A fidelity bond insures the retirement plan against losses due to fraud or theft by people who handle the plan's funds or property. Fiduciary insurance, on the. A fidelity bond is no-cost insurance coverage from $5, up to $25, that enables employers to hire job applicants considered to be "at risk" due to their. What does a fidelity bond cover? Fidelity bonds typically cover losses due to employee dishonesty and fraudulent acts. This can include theft of money. Fidelity Bond Coverage and Deductible Amounts · total UPB of single-family and multifamily annual mortgage loan originations; or · highest monthly total UPB of. Bond Coverage. What Exactly Does the Bond Insurance Cover? It insures the employer for any type of stealing by theft, forgery, larceny, or embezzlement. It does. Fidelity bond insurance (or fidelity bonds) covers any losses that result from the dishonest or criminal actions of your employees. Crime and fidelity insurance. Fidelity bonds can be relatively inexpensive, costing as little as 1% to 3% of the bond's full coverage amount. For example, the premium for a $10, bond. A fidelity bond, or ERISA bond, is an insurance policy that provides a (k) plan with protection from losses caused by any fraudulent behavior—such as. Fidelity bonds protect a business from any wrongdoing on the part of an employee. They are often used to cover things such as theft and property damage. Another key difference is that the fidelity bond specifically provides coverage for loss resulting from fraud or dishonesty, but fiduciary liability policies. Any type of forgery, fraud, or theft is typically covered by fidelity bonds. Even if the employee (or client) successfully commits the act, the bond covers the. All nonprofit organizations who receive a grant need Fidelity Bond coverage. The nonprofit is the party insured. This insurance should cover the dishonest acts. ERISA Fidelity coverage helps protect an employee benefit plan against losses caused by acts of fraud or dishonesty, such as larceny, theft, embezzlement. A fidelity bond is a form of insurance protection that covers policyholders for losses that they incur as a result of fraudulent acts by specified individuals. Fidelity bonds protect employers from damages associated with losses that employees cause. For example, if an employee acts dishonestly or commits fraud and. A fidelity bond is akin to a type of insurance that protects a company and its customers from financial loss due to dishonest acts by employees. Any type of forgery, fraud, or theft is typically covered by fidelity bonds. Even if the employee (or client) successfully commits the act, the bond covers the.

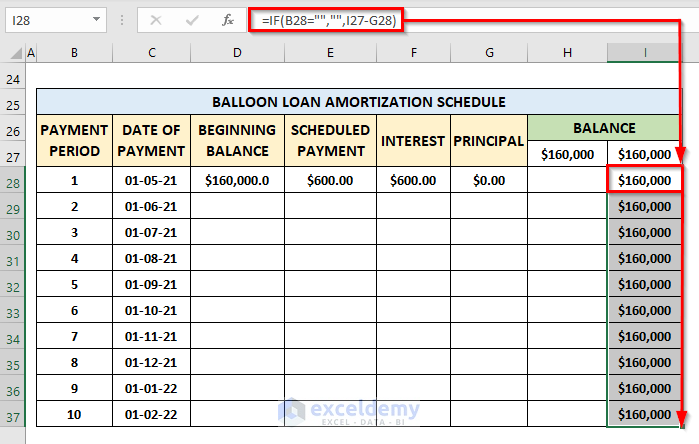

How Do You Calculate Interest Only Payments

Interest Only Loan Payment Calculator This calculator will compute a loan's monthly interest-only payment. Principal: Interest Rate. Your total payment is $1, for the interest-only period *This is not a commitment to lend. Subject to credit approval. Property insurance required for all. Use this calculator to compute the monthly payment amount for an interest-only fixed rate loan. Enter the principal amount (do not include a $ symbol or commas). Interest Only / Conventional Calculator · Your interest only rate per period: % For 24 total periods ( years) for an interest only payment of $. If the borrower exercises the interest-only option every month during the interest-only period, the payment will not include any repayment of principal. The. To calculate the monthly payment on an interest only loan, simply multiply the loan balance times the monthly interest rate. How to Calculate Payments · PMT = total payment each period · PV = present value of loan (loan amount) · i = period interest rate expressed as a decimal · n. A “Cash-Out” IO mortgage loan would offer Interest-Only payments. It makes borrowing money even cheaper (think of it like a bank account) and allows you to make. This interest only loan calculator figures your monthly payment amount for any interest only loan. Just two simple inputs makes the math easy for you. Interest Only Loan Payment Calculator This calculator will compute a loan's monthly interest-only payment. Principal: Interest Rate. Your total payment is $1, for the interest-only period *This is not a commitment to lend. Subject to credit approval. Property insurance required for all. Use this calculator to compute the monthly payment amount for an interest-only fixed rate loan. Enter the principal amount (do not include a $ symbol or commas). Interest Only / Conventional Calculator · Your interest only rate per period: % For 24 total periods ( years) for an interest only payment of $. If the borrower exercises the interest-only option every month during the interest-only period, the payment will not include any repayment of principal. The. To calculate the monthly payment on an interest only loan, simply multiply the loan balance times the monthly interest rate. How to Calculate Payments · PMT = total payment each period · PV = present value of loan (loan amount) · i = period interest rate expressed as a decimal · n. A “Cash-Out” IO mortgage loan would offer Interest-Only payments. It makes borrowing money even cheaper (think of it like a bank account) and allows you to make. This interest only loan calculator figures your monthly payment amount for any interest only loan. Just two simple inputs makes the math easy for you.

To calculate interest-only loan repayments, you need to multiply the principal amount by the loan's interest rate and divide it by repayment frequency. For. Interest is calculated monthly at 1/th of the annual rate times the number of days in the month on the current outstanding balance of your loan. "Qualify Payment Type" has both Principal and Interest (PI) and IO calculation options. If PI is selected, the qualifying monthly PI is calculated based on the. First interest-only payment: The initial mortgage payment in which only interest is paid, without reducing the principal balance, standard in construction loans. The example below shows how to compute an interest-only payment on the BA II PLUS and BA II PLUS PROFESSIONAL. You can calculate an approximate interest-only payment in the following way loan payments might look like as your home construction progresses. An interest-only loan is one in which the borrower pays only the interest due on the loan during a specified period, usually for the first few years of the loan. Interest-only mortgages are primarily designed for borrowers who stand to make a profit from their loan-funded purchase. For example, if you flip houses, you. The accelerated bi-weekly payment is calculated by dividing your monthly payment by two. You then make 26 bi-weekly payments. Just like the accelerated weekly. First enter the principal amount of the loan and its interest rate. Then click on CALCULATE. Instantly, you'll see what your interest-only payment will be. Interest amounts for each payment are tabulated using formulas derived from the APR. Daily periodic rate, for example, is a figure used to determine interest. Choose interest only to make interest only payments. Choose Principal + Interest for a loan that has a fixed principal payment plus accrued interest. Use this HELOC interest only calculator to see how your monthly payment could change between the draw and repayment phases, depending on how much you. Calculations are based on your current mortgage being on a repayment (capital and interest) basis · You make your payments on time for the rest of your term · We. At its most basic, an interest-only mortgage is one where you only make interest payments for the first several years—typically five or 10—and once that period. This tool helps buyers calculate current interest-only payments, but most interest-only loans are adjustable rate mortgages (ARMs). As the name indicates, an interest-only mortgage is one where you only pay the interest charges. You don't have to make any payments against the loan principle. NerdWallet's interest-only mortgage calculator compares the payments during the interest-only period to the payments of a fully amortizing mortgage. As you are only paying the interest each month, interest only mortgages have lower monthly payments than those of repayment mortgages. With a repayment mortgage. To use the calculator simply enter the loan principal amount and loan interest rate and the interest-only mortgage calculator will calculate the payment amounts.

Alibaba Tock

Alibaba Group Holding Ltd. ADR ; Market Value, $B ; Shares Outstanding, B ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. On 19 September , Alibaba's initial public offering on the New York Stock Exchange raised US$25 billion, giving the company a market value of US$ Find the latest Alibaba Group Holding Limited (BABA) stock quote, history, news and other vital information to help you with your stock trading and investing. Get the latest updates on Alibaba Group Holding Limited American Depositary Shares each representing eight Ordinary share (BABA) pre market trades. Get Alibaba Group Holding Ltd (BABA.N) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Alibaba Group Holding Ltd. ADR · AT CLOSE PM EDT 08/30/24 · USD · % · Volume20,, Find the latest Alibaba Group Holding Limited (HK) stock quote, history, news and other vital information to help you with your stock trading and. View Alibaba Group Holding Limited Sponsored ADR BABA stock quote prices, financial information, real-time forecasts, and company news from CNN. The Alibaba Group Holdings Ltd ADR stock price today is What Is the Stock Symbol for Alibaba Group Holdings Ltd ADR? The stock ticker symbol for Alibaba. Alibaba Group Holding Ltd. ADR ; Market Value, $B ; Shares Outstanding, B ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. On 19 September , Alibaba's initial public offering on the New York Stock Exchange raised US$25 billion, giving the company a market value of US$ Find the latest Alibaba Group Holding Limited (BABA) stock quote, history, news and other vital information to help you with your stock trading and investing. Get the latest updates on Alibaba Group Holding Limited American Depositary Shares each representing eight Ordinary share (BABA) pre market trades. Get Alibaba Group Holding Ltd (BABA.N) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Alibaba Group Holding Ltd. ADR · AT CLOSE PM EDT 08/30/24 · USD · % · Volume20,, Find the latest Alibaba Group Holding Limited (HK) stock quote, history, news and other vital information to help you with your stock trading and. View Alibaba Group Holding Limited Sponsored ADR BABA stock quote prices, financial information, real-time forecasts, and company news from CNN. The Alibaba Group Holdings Ltd ADR stock price today is What Is the Stock Symbol for Alibaba Group Holdings Ltd ADR? The stock ticker symbol for Alibaba.

See BABA stock price and Buy/Sell Alibaba. Discuss news and analysts' price predictions with the investor community. On eToro, you can buy $BABA or other stocks and pay ZERO commission! Follow Alibaba-ADR share price and get more information. Terms apply. | Complete Alibaba Group Holding Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. View today's Alibaba Group Holding Ltd stock price and latest news and analysis. Create real-time notifications to follow any changes in the live stock. Alibaba's ordinary shares are primarily traded on the Hong Kong Stock Exchange (HKEX) under the ticker symbol "" Ordinary shareholders have voting rights. BABA - Alibaba Group Holding Ltd ADR - Stock screener for investors and traders, financial visualizations. Stock Price Forecast. The 16 analysts with month price forecasts for Alibaba stock have an average target of , with a low. An easy way to get Alibaba Group Holdings Ltd. real-time prices. View live BABA depositary receipt chart, financials, and market news. Alibaba stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. r/AlibabaStock: A place for high quality news and discussion on the Chinese e-commerce giant Alibaba (NYSE: $BABA). Alibaba Group Holding Limited American Depositary Shares each representing eight Ordinary share (BABA) Stock Price, Quote, News & History | Nasdaq. Stock analysis for Alibaba Group Holding Ltd (BABA:New York) including stock price, stock chart, company news, key statistics, fundamentals and company. Get the latest BABA stock price (NYSE: BABA) and detailed information including stock rating, news, historical charts and real-time prices, stock analyst. Alibaba had a market value of approximately USD billion in mid, making it one of the world's financially strongest companies. Alibaba Group Holding Ltd. engages in providing technology infrastructure and marketing reach. It operates through the following business segments: China. Alibaba (BABA) has a Smart Score of 10 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity. Stock analysis for Alibaba Group Holding Ltd (Hong Kong) including stock price, stock chart, company news, key statistics, fundamentals and company. Alibaba Group Holding Limited (yowordpress.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Alibaba Group Holding Limited. Based on 16 Wall Street analysts offering 12 month price targets for Alibaba in the last 3 months. The average price target is $ with a high forecast of. The 64 analysts offering price forecasts for Alibaba have a median target of , with a high estimate of and a low estimate of

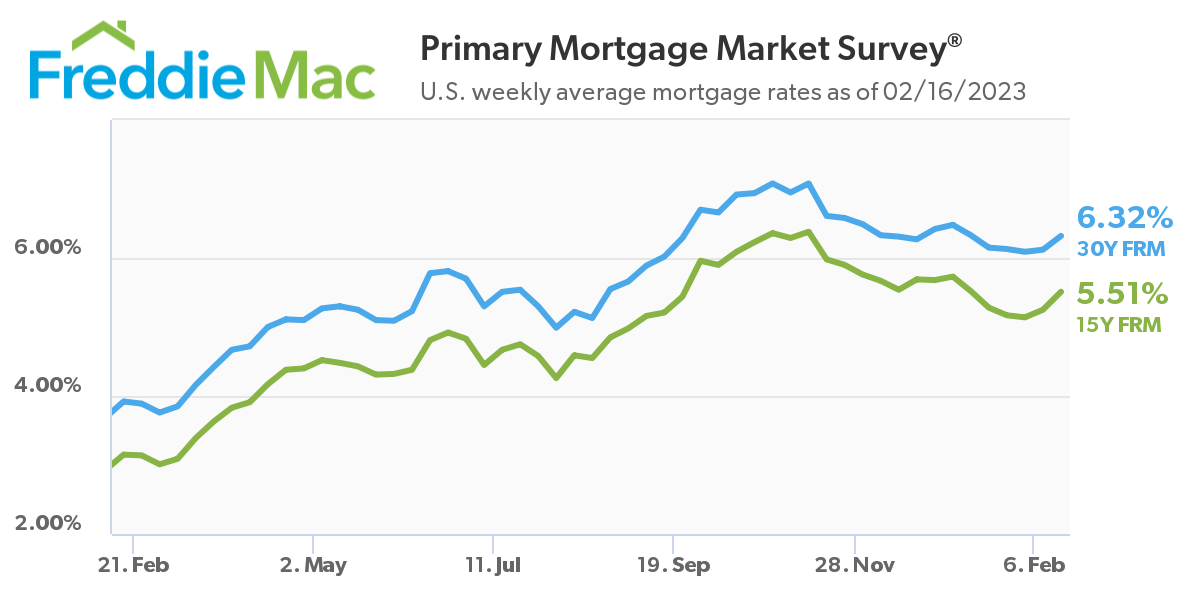

Freddie Mac Interest Rate Survey

Freddie Mac surveys lender data weekly to find the average rate of mortgage loans submitted to them by banks, credit unions, and mortgage companies. MND's 30 Year Fixed (daily survey) · MBA 30 Year Fixed (weekly) · Freddie Mac 30 Year Fixed (weekly). The Primary Mortgage Market Survey® is based on loan applications submitted to Freddie Mac by lenders across the country and shows the average year fixed-. On November 17, , Freddie Mac changed the methodology of the Primary Mortgage Market Survey® (PMMS®). The weekly mortgage rate is. On January 1, , FreddieMac ceased publishing regional rates in its weekly Primary Mortgage Market Survey (PMMS). Accordingly, when calculating interest rate. The Freddie Mac Primary Mortgage Market Survey surveys lenders weekly with results released each Thursday at 10 am EST. year fixed-rate mortgage averaged percent as of March 9, , up from last week when it averaged percent. · year fixed-rate mortgage averaged. The chart below shows interest rates for year fixed-rate, year fixed-rate, and 5/1 ARM mortgages as reported by Freddie Mac to the Federal Reserve Bank. On November 17, , Freddie Mac changed the methodology of the Primary Mortgage Market Survey® (PMMS®). The weekly mortgage rate is. Freddie Mac surveys lender data weekly to find the average rate of mortgage loans submitted to them by banks, credit unions, and mortgage companies. MND's 30 Year Fixed (daily survey) · MBA 30 Year Fixed (weekly) · Freddie Mac 30 Year Fixed (weekly). The Primary Mortgage Market Survey® is based on loan applications submitted to Freddie Mac by lenders across the country and shows the average year fixed-. On November 17, , Freddie Mac changed the methodology of the Primary Mortgage Market Survey® (PMMS®). The weekly mortgage rate is. On January 1, , FreddieMac ceased publishing regional rates in its weekly Primary Mortgage Market Survey (PMMS). Accordingly, when calculating interest rate. The Freddie Mac Primary Mortgage Market Survey surveys lenders weekly with results released each Thursday at 10 am EST. year fixed-rate mortgage averaged percent as of March 9, , up from last week when it averaged percent. · year fixed-rate mortgage averaged. The chart below shows interest rates for year fixed-rate, year fixed-rate, and 5/1 ARM mortgages as reported by Freddie Mac to the Federal Reserve Bank. On November 17, , Freddie Mac changed the methodology of the Primary Mortgage Market Survey® (PMMS®). The weekly mortgage rate is.

interest rates and monthly payments. Report, Primary Mortgage Market Survey. Category, Interest Rates. Region, United States. Source, Freddie Mac. Stats. Last. interest rates and monthly payments. Report, Primary Mortgage Market Survey. Category, Interest Rates. Region, United States. Source, Freddie Mac. Stats. Last. The chart below shows interest rates for year fixed-rate, year fixed-rate, and 5/1 ARM mortgages as reported by Freddie Mac to the Federal Reserve Bank. interest rates and monthly payments. Report, Primary Mortgage Market Survey. Category, Interest Rates. Region, United States. Source, Freddie Mac. Stats. Last. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Catch a glimpse into the future of home financing with our expert insights on the mortgage industry's interest rate projections. Freddie Mac surveys lender data weekly to find the average rate of mortgage loans submitted to them by banks, credit unions, and mortgage companies. The average year fixed rate mortgage (FRM) held at % from Aug. 29 to Sept. 5, according to Freddie Mac. “Mortgage rates remained flat this week as. year fixed-rate mortgage averaged percent as of March 9, , up from last week when it averaged percent. · year fixed-rate mortgage averaged. The Primary Mortgage Market Survey® is based on loan applications submitted to Freddie Mac by lenders across the country and shows the average year fixed-. year fixed-rate mortgage averaged percent as of October 12, , up from last week when it averaged percent. A year ago at this time, the year. Monthly Interest Rate Survey (discontinued as of 5/29/) In addition the survey provided quarterly information on conventional loans by major metropolitan. While the Freddie Mac survey rate is a good measure in the sense that it holds the loan product, loan purpose, and borrower profile constant to exclude. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. The average rate on a year fixed mortgage held steady at % as of September 5th, remaining at its lowest level since mid-May , according to Freddie. MND's 30 Year Fixed (daily survey) · MBA 30 Year Fixed (weekly) · Freddie Mac 30 Year Fixed (weekly). year fixed-rate mortgage averaged percent as of October 12, , up from last week when it averaged percent. A year ago at this time, the year. Monthly Interest Rate Survey (discontinued as of 5/29/) In addition the survey provided quarterly information on conventional loans by major metropolitan. On January 1, , FreddieMac ceased publishing regional rates in its weekly Primary Mortgage Market Survey (PMMS). Accordingly, when calculating interest rate. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term.

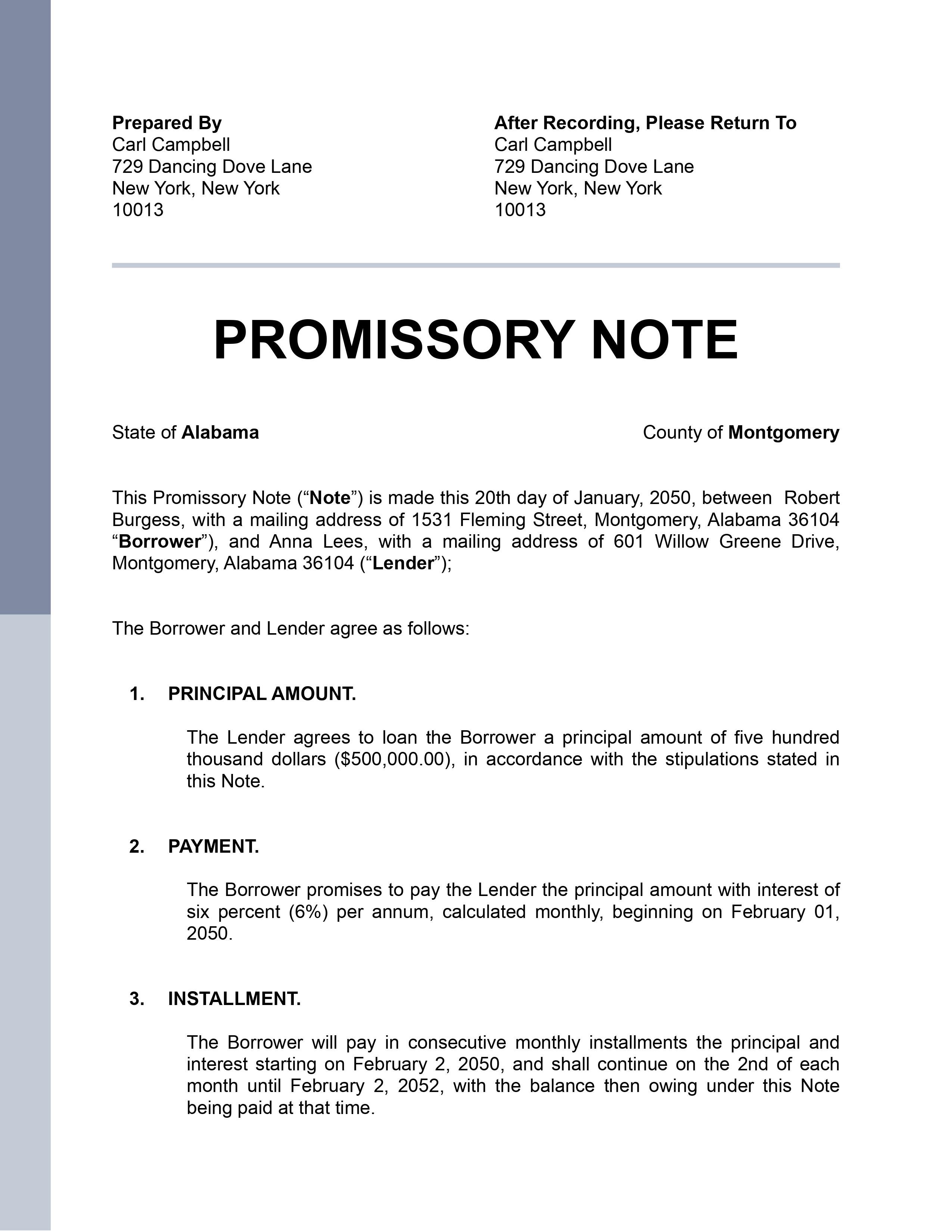

What Should Be Included In A Promissory Note

A promissory note should include information such as the total amount of money being borrowed, the interest rate (if any), repayment terms, and the date by. What's Included in a Promissory Note? A promissory note should include all the details about a loan and the repayment terms. In addition to the names of the. As the name suggests, this is a promissory note with only the basics included: the amount owed, the terms, and payment schedule. Simple promissory notes are. 9 Key Elements All Promissory Notes Should Include · Names and Contact Information · Total Loan Amount · Interest Rate On The Loan · Collateral · Signatures · Payment. A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline. If you ever take out a loan for yourself or your business, you may need to sign a promissory note. A promissory note is a document that spells out your. A promissory note is a legal document between the borrower and lender for full mortgage repayment. Learn how promissory notes work and what is included. The note always should set forth, at a minimum, the parties, the amount owed, the payment terms, the interest rate, and the creditor's remedies upon default. Names of Parties: The first paragraph will include the name of the debtor as well as their address. The creditor's full name should also be included along with. A promissory note should include information such as the total amount of money being borrowed, the interest rate (if any), repayment terms, and the date by. What's Included in a Promissory Note? A promissory note should include all the details about a loan and the repayment terms. In addition to the names of the. As the name suggests, this is a promissory note with only the basics included: the amount owed, the terms, and payment schedule. Simple promissory notes are. 9 Key Elements All Promissory Notes Should Include · Names and Contact Information · Total Loan Amount · Interest Rate On The Loan · Collateral · Signatures · Payment. A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline. If you ever take out a loan for yourself or your business, you may need to sign a promissory note. A promissory note is a document that spells out your. A promissory note is a legal document between the borrower and lender for full mortgage repayment. Learn how promissory notes work and what is included. The note always should set forth, at a minimum, the parties, the amount owed, the payment terms, the interest rate, and the creditor's remedies upon default. Names of Parties: The first paragraph will include the name of the debtor as well as their address. The creditor's full name should also be included along with.

the term "promissory note" inserted in the body of the instrument and expressed in the language employed in drawing up the instrument · an unconditional promise. A promissory note evidences an obligation to repay a loan. Promissory notes can be issued as standalone documents that contain all essential loan terms. What Should I Include in a Promissory Note? · Payor or borrower: Include the name of the party who promised to repay the stated debt · Payee or lender: · Date. Promissory notes act as a legal promise that a borrower will repay their debt. Learn more about how these contracts work and how to create your own. A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline. BY SIGNING BELOW, Borrower accepts and agrees to the terms and covenants contained in this Note. All replacements and additions shall also be covered by this. CURRENCY: All principal and interest payments shall be made in lawful money of the United States. 7. LATE CHARGE: If Holder receives any installment payment. BY SIGNING BELOW, Borrower accepts and agrees to the terms and covenants contained in this Note. All replacements and additions shall also be covered by this. The promissory note will specify the amount of money that the company has borrowed, the interest rate on the loan, and the date by which the loan must be repaid. A promissory note is a written promise to pay back a definite sum of money (typically, a loan), between you (the borrower) and a lender. What Should Be Included in a Promissory Note. Most promissory notes will include the name of the borrower and the name of the entity or person making the loan. A promissory note must be in writing and signed by the maker of the promise. contain an acknowledgment by a bank that the bank has received for deposit. The note must also contain the terms and conditions between the two parties involved. This includes the amount of money or capital loaned, the interest rate and. What should a promissory note include? · Name of the party that promised to repay the stated debt. · Lender's name (Payee or lender) · Exact date(s) the promise to. A promissory note evidences an obligation to repay a loan. Promissory notes can be issued as standalone documents that contain all essential loan terms. Promissory Notes - The Basics · 1. Identification of Parties · 2. Amount owed and interest to be charged. · 3. Date of payments. · 4. Right to assign (transfer the. A promissory note is a written pledge given by a borrower to repay money. If interest is charged, the rate should be included with a repayment schedule. It. Writing Your Own Promissory Note · The amount of the loan — the amount that is borrowed and owed. · Repayment dates — the date payments are due or the loan must. The promissory note must include clear terms and conditions that specify the parties' obligations, including the amount of money owed, the interest rate, and. A Promissory Note is a legal contract between a lender and a borrower that defines the terms of a loan, including payment details, interest, late fees, any.

How To Make A 401k Account

Talk to HR about enrolling in your (k) If you're interested in opening a (k), talk with your employer to learn about how your company's plan works. If. With a basic understanding of the features of a (k) retirement plan and how they work, you'll be much better prepared to make the most of this important. Follow these steps to build, manage, and make contributions to your retirement plan. Skip to Page Navigation. Step 1. Establish your Individual (k) plan. So, it's important to make sure that you're keeping track of old accounts when you change employers. When it comes to managing your old (k) account, there. The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans. The earlier you start investing, the more time your money has to grow. One of the biggest advantages of investing in a (k) early is compound interest. Steps to establishing a (k) plan · Types of automatic enrollment · Automatic enrollment increases and sample plan language · How to establish designated Roth. Give Participants Access to Their Account. Easily manage accounts, check retirement contribution amounts, maximize (k) contributions, review investment. How Do You Start a (k)? · Contact your employer. · If a (k) is available, the company will instruct you how to sign up with new paperwork. · Choose your. Talk to HR about enrolling in your (k) If you're interested in opening a (k), talk with your employer to learn about how your company's plan works. If. With a basic understanding of the features of a (k) retirement plan and how they work, you'll be much better prepared to make the most of this important. Follow these steps to build, manage, and make contributions to your retirement plan. Skip to Page Navigation. Step 1. Establish your Individual (k) plan. So, it's important to make sure that you're keeping track of old accounts when you change employers. When it comes to managing your old (k) account, there. The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans. The earlier you start investing, the more time your money has to grow. One of the biggest advantages of investing in a (k) early is compound interest. Steps to establishing a (k) plan · Types of automatic enrollment · Automatic enrollment increases and sample plan language · How to establish designated Roth. Give Participants Access to Their Account. Easily manage accounts, check retirement contribution amounts, maximize (k) contributions, review investment. How Do You Start a (k)? · Contact your employer. · If a (k) is available, the company will instruct you how to sign up with new paperwork. · Choose your.

Named for the tax code section that created it, a (k) is an employer-sponsored retirement savings plan with special tax benefits. (The exact tax advantages. Generally speaking, employees cannot contribute to the account; the employer makes all the contributions. The exception would be if the plan permits employees. In general, a (k) is a retirement account that your employer sets up for you. Make the most of your (k). Paycheck impact calculator · Enroll in your. (k) plans are designed to help employees grow their retirement savings. Once a plan is established, it goes through a period of tax-deferred growth before an. To fully establish your plan, you'll also need to complete the self-employed (k) account application, adoption agreement and trust agreement. Please keep. (k) loans allow you to borrow money from a (k) account or certain other qualifying retirement plans, such as a (b). (k) loans have certain benefits. See if your provider can do what's called a trustee-to-trustee rollover or direct rollover. That's when your current retirement account provider will send a. Basically, you put money into the (k) where it can be invested and potentially grow tax free over time. In most cases, you choose how much money you want to. The most common match formula is 50 cents for every dollar saved, up to 6% of your pay. Employees participating in a plan with this type of formula need to. How to Set Up a (k) Plan for Your Business · Select the Plan Design that Best Fits Your Needs. · Pick a Provider with Low Fund Expenses and Purchase Your Plan. When reviewing potential (k) plans, make sure you're aware of all applicable fees before signing up. You may also want to look for a plan that offers a wide. A person working for a job that didn't offer a k could always open an IRA account on their own. Mandating a k seems like it would. When you start a job with a company that offers a Roth (k) plan, you have the option of enrolling in the retirement plan. You are not obligated to do so, and. (k) plans are retirement plans that help you save for the future. They allow you to save for your future out of your earnings, and your employer might also. While stashing away money in a retirement plan like a (k) is a great start, there's even more that savers can do to get the most bang for their buck. Here. Using a matching contribution formula will provide employer contributions only to employees who contribute to the (k) plan. If you choose to make nonelective. CalSavers is California's new retirement savings program designed to give Californians an easy way to save for retirement. Visit our website today to learn. How to Set up a (k) Plan · If you're self employed, decide if you want a SoloK, SEP, or SIMPLE. · Decide if you want to use a financial advisor (like me) or. Consider contributing to your workplace retirement account up to the employer match. If you have a retirement plan through an employer—for example, a (k) or. With a traditional (k), you fund your account with pre-tax dollars. Because your contributions are withdrawn from your paycheck before you've paid any taxes.

Does Applying For Amazon Card Hurt Credit

Being denied for a credit card doesn't hurt your credit score. But the hard inquiry from submitting an application can cause your score to decrease. However, when you submit an application, a hard credit inquiry will be placed, which may impact your credit score. Why do I need to provide the last four digits. To get approved for this card, you'll need to have a good credit score of at least , though having a higher one certainly won't hurt your chances. Subscribe. When you apply for or check to see if you prequalify for Affirm financing, it's considered a soft inquiry, which does not affect your credit score. If you. application. How does credit card preapproval work if there's no hard pull? So how can a bank determine if you're a good fit for their credit card if they. Easily compare and apply online for Fair credit score credit cards with Visa. Find Visa credit cards with low interest rates, rewards and other benefits. A hard inquiry from a card application can cause a small, temporary drop in credit scores. A denial or approval won't hurt your credit scores, because decisions. Yes, a credit card issuer will typically place a hard inquiry on your credit report when you apply for either secured or unsecured credit cards. How do you make. A hard inquiry from a card application can cause a small, temporary drop in credit scores. A denial or approval won't hurt your credit scores, because decisions. Being denied for a credit card doesn't hurt your credit score. But the hard inquiry from submitting an application can cause your score to decrease. However, when you submit an application, a hard credit inquiry will be placed, which may impact your credit score. Why do I need to provide the last four digits. To get approved for this card, you'll need to have a good credit score of at least , though having a higher one certainly won't hurt your chances. Subscribe. When you apply for or check to see if you prequalify for Affirm financing, it's considered a soft inquiry, which does not affect your credit score. If you. application. How does credit card preapproval work if there's no hard pull? So how can a bank determine if you're a good fit for their credit card if they. Easily compare and apply online for Fair credit score credit cards with Visa. Find Visa credit cards with low interest rates, rewards and other benefits. A hard inquiry from a card application can cause a small, temporary drop in credit scores. A denial or approval won't hurt your credit scores, because decisions. Yes, a credit card issuer will typically place a hard inquiry on your credit report when you apply for either secured or unsecured credit cards. How do you make. A hard inquiry from a card application can cause a small, temporary drop in credit scores. A denial or approval won't hurt your credit scores, because decisions.

Yes it will affect your credit score. Annette Sullins. · 9 years ago. Helpful?

Getting prequalified for a credit card does not negatively affect your credit score. This is because card issuers typically use what's called a soft inquiry. Before applying for a credit card, consider getting pre-approved to see which cards you qualify for. It's quick, easy, and won't hurt your credit score. And. How does applying for the card impact my credit score? Completing the application will not impact your credit score but all account openings and payment. This is a hard inquiry which may have an impact on your score. Do I have to re-apply every time I use Dell Pay? No. Unlike some other popular forms of. Getting the card will make your credit score drop slightly for a very short period of time, but assuming that you're not getting a mortgage. There is no impact to your credit bureau score when you submit a prequalification check. However, if you do prequalify and then proceed with applying for the. Apply with no impact to your credit score if declined.1; Earn up to 3% cash Offer excludes gift cards and does not apply to purchases made on QVC+. If you're facing a credit check for employment, understand that society—including some employers—sometimes makes character judgments based on how people manage. Chase, which issues the credit card, does not disclose a minimum credit score requirement. However, for a solid chance of your application being approved, it's. Soft pulls and department store credit cards. A soft inquiry or "soft pull" is another form of credit check, but it does not provide as much information and won. Online shopping for Affirm from a great selection at Credit & Payment Cards Store. Manage your Amazon Store Card or Amazon Secured Card with the Amazon Store Card app. • Review your account activity, including transaction amount and item. However, there's a risk that using them may impact your personal credit score, as some credit card issuers report your activity to the consumer credit bureaus. Hard inquiries typically occur when you apply for a credit card, mortgage or other loan. Other lenders can see hard inquires, and hard inquiries could affect. But if you decide to finally apply for that credit card offer, a hard inquiry will be run by the issuer, and this could negatively affect your credit score. Your credit utilization ratio may increase. Closed credit card accounts can negatively impact your credit score for several reasons. When an account is canceled. That being said, credit cards do differ from debit cards and there are more eligibility requirements for the debit card than for the credit card, and there's no. When you apply for or check to see if you prequalify for Affirm financing, it's considered a soft inquiry, which does not affect your credit score. If you. At this time, only some Affirm loan types are eligible to be reported to Experian. These things won't affect your credit score: Creating an Affirm account.

1 2 3 4 5